This article was shortlisted as a finalist in the 2024 E-International Relations Article Award, sponsored by Edinburgh University Press, Polity, Sage, Bloomsbury and Routledge.

In the aftermath of the 2007–08 Global Financial Crisis, the Western world has dealt with a range of crises that simultaneously gave China a series of an opportunities. Its subsequent growth within political, economic, and military domains has caught the world off guard – and caused a shift in the power balance between China and the EU. With the deepening of economic cooperation and multiple areas involved, the Belt and Road Initiative (BRI) was proposed by China in 2013. However, after dealing with the financial crisis, the subsequent refugee crisis, Brexit, the pandemic, and the Russia-Ukraine war, the EU’s internal disagreements and conflicts are ever more pronounced. In this context, with its internal issues, the EU is facing a situation that shifts the power of the China-EU relations and China’s strong and aggressive economic actions. Despite Brussels noticing this and attempting to cope by proposing related policies, the situation often catches Brussels off guard due to the speed of developments. Cooperation is, therefore, the better alternative due to the current political and economic circumstances. Eighteen European Union nations are currently a part of the BRI, according to official Chinese government statistics, yet the EU itself still hesitates to sign an agreement with China as seen by its absence in the BRI memorandum’s list.

According to the current public speeches, data, and arrangements, there are two main reasons for the prudence and hesitation of the EU. One is that the mega-project involved too much money, and most projects are infrastructure construction and investment. According to the OECD’s report China’s Belt and Road Initiative in the Global Trade, Investment and Finance Landscape in 2018, global infrastructure investment is, on average, falling short by USD 0.35-0.37 trillion per year (“The Belt and Road Initiative in the Global Trade, Investment and Finance Landscape” 2018). It points out that the BRI faces a growing global infrastructure investment deficit at present and in the future. In this regard, the EU is sceptical about joining this Initiative as the infrastructure is a key connectivity sector to the investment deficit. Another reason is that the EU is sceptical and worried about the intention of the BRI. This economic project has a potential influence on the unity of the EU. Furthermore, whether the potential political influence of the BRI on geopolitics weakens the EU’s presence and influence in Eurasia.

Overall, China-EU relations have entered a new stage, and both sides have little experience facing the other with different appearances. The process of deepening and promoting the economic cooperation between China and the EU faces challenges. Discussing and analyzing the challenges is essential for the following arrangements and influencing the two sides likely to take and make.

Priorities and Issues of Processing the Belt and Road Initiative

The Belt and Road Initiative, an economic mega-project, has been developing for over a decade since it was proposed first in 2013. According to the China Belt and Road Initiative (BRI) Investment Report H1 2022 produced by the Green Finance & Development Center (GFDC) of the Fanhai International School of Finance at Fudan University, the cumulative BRI engagement amounts to US$932 billion (Nedopil 2022). The main aims of the BRI are connecting global value chains, promoting regional integration, and efficient use of resources, and one crucial goal of the BRI’s infrastructure investment is to reduce trade costs and promote market integration along the BRI countries (Bashir 2021, 19-21). It is not a Chinese foreign aid program but a platform for pursuing pragmatic collaboration. Mutual discussion, mutual construction, and mutual sharing are the core principles of this initiative. As the OECD mentioned, the world has a large infrastructure gap constraining trade, openness, and future prosperity (OECD 2018). Scholars emphasize the importance of infrastructure construction along the BRI countries to boost the regional economy, whether the physical stocks, such as the roads and ports, or social development, such as social services (Canning and Pedroni 2008, 524).

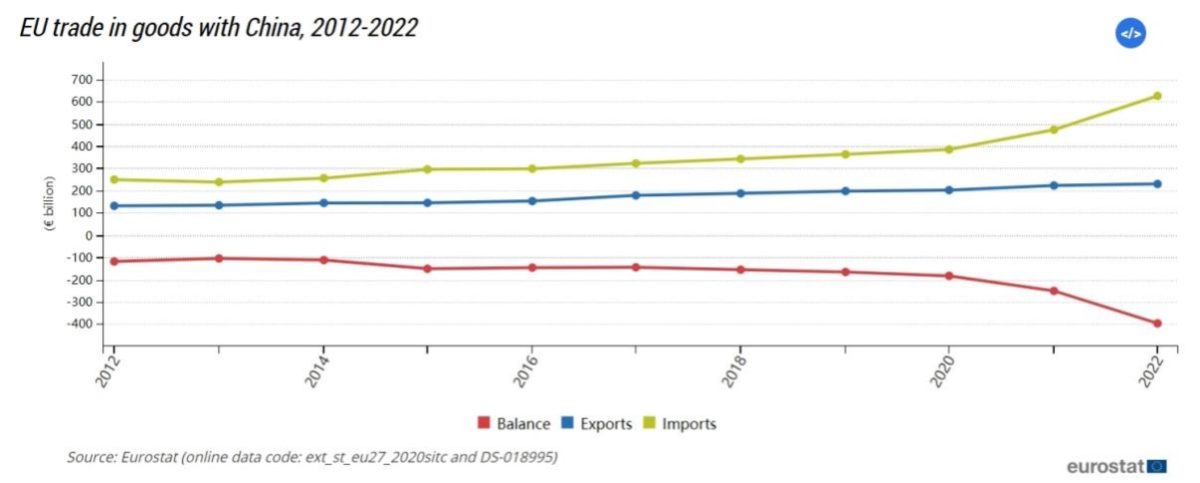

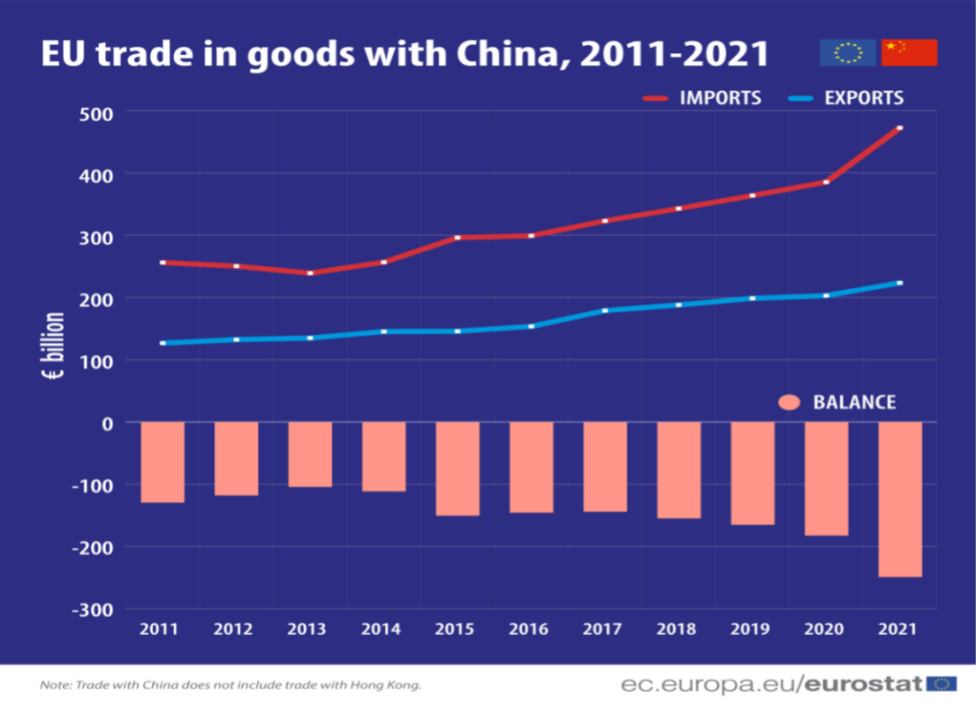

In 2021, the total value of imports and exports between China and countries along the BRI increased from 6.5 trillion yuan to 11.6 trillion yuan, an average annual growth rate of 7.5%, and the proportion of Chinese total foreign trade value in the same period increased from 25% to 29.7% (National Bureau of Statistics of China 2022). China is the EU’s second-biggest commercial partner behind the United States. Besides, exports from the EU to China are outpacing those from China to the EU (see Figure 1), despite China being the second-largest market for EU exports after the US. The EU’s trade deficit with China is evident and affects the China-EU economic relations.

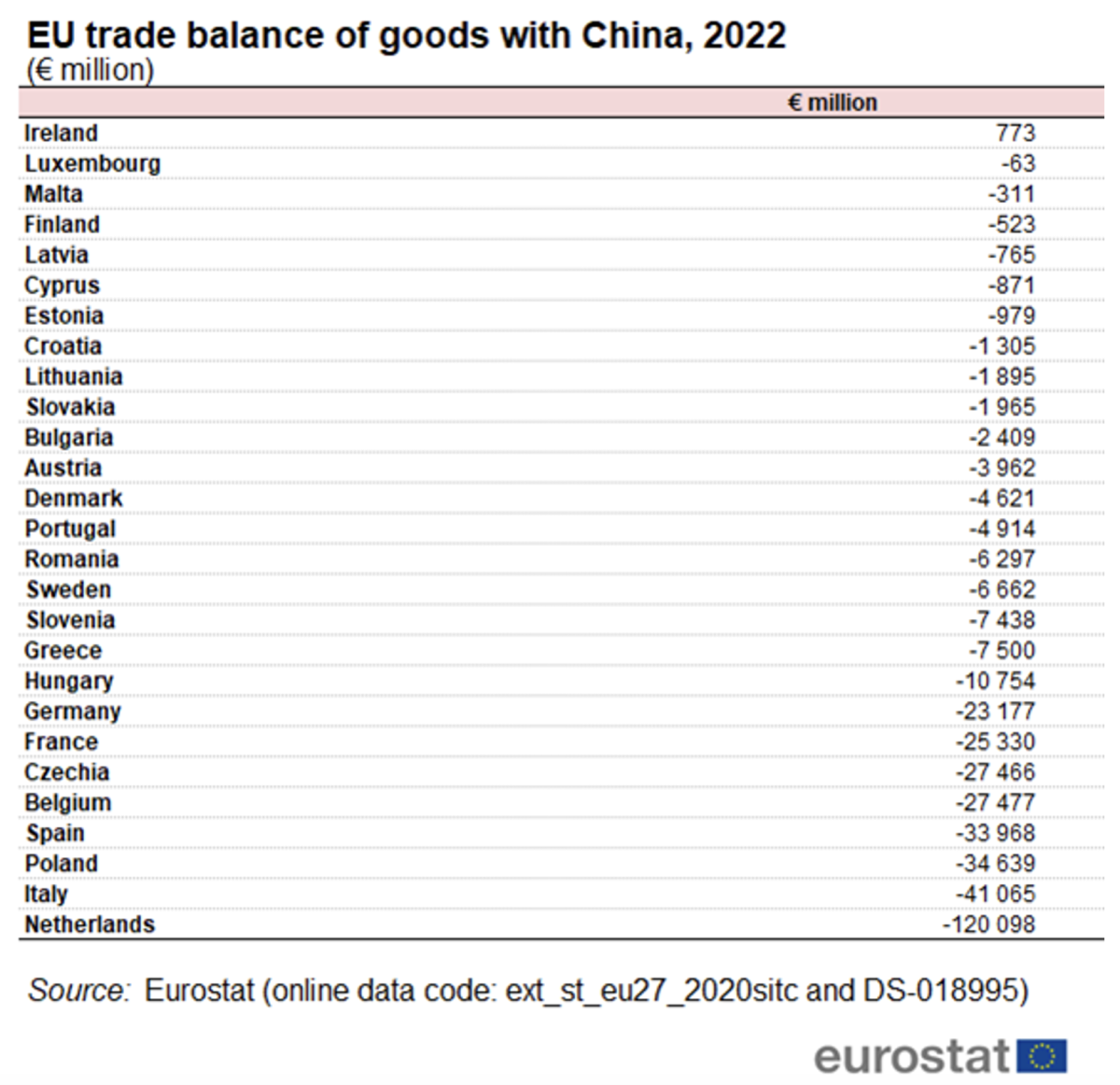

As the largest developing country, China benefited from reducing the tariffs faced by its exporters because of the most-favored-nation principle since it joined WTO in 2001. Most trade between China and the EU is in goods such as mechanical and electrical and labor-intensive products, with little trade in services. With the development of China Railway Express, transportation cost is reduced, and transportation time is shortened, which increases the export volume of goods. However, the EU questions if it is still necessary to apply the most-favored-nation principle to China as it has been the second-largest world economy. The EU trade imbalance of goods with China is still an evident situation and problem (see Figure 2) for economic cooperation.

Trade balance issues are also present in the BRI. China’s free trade areas along the BRI-covered countries undermine the EU’s trade gains. For example, trade gains arise from removing trade tariffs from free trade agreements with countries along the BRI. Moreover, the trade gains through the free trade areas influence the EU’s economic cooperation with these countries. Aside from the China-US trade war, the BRI is crucial to the EU as it has clear geographic coverage. The EU can benefit from the mega economic project, but ensuring its benefits and economic security is also a significant problem for the EU. Brussels and the EU member states are still thinking and finding a solution.

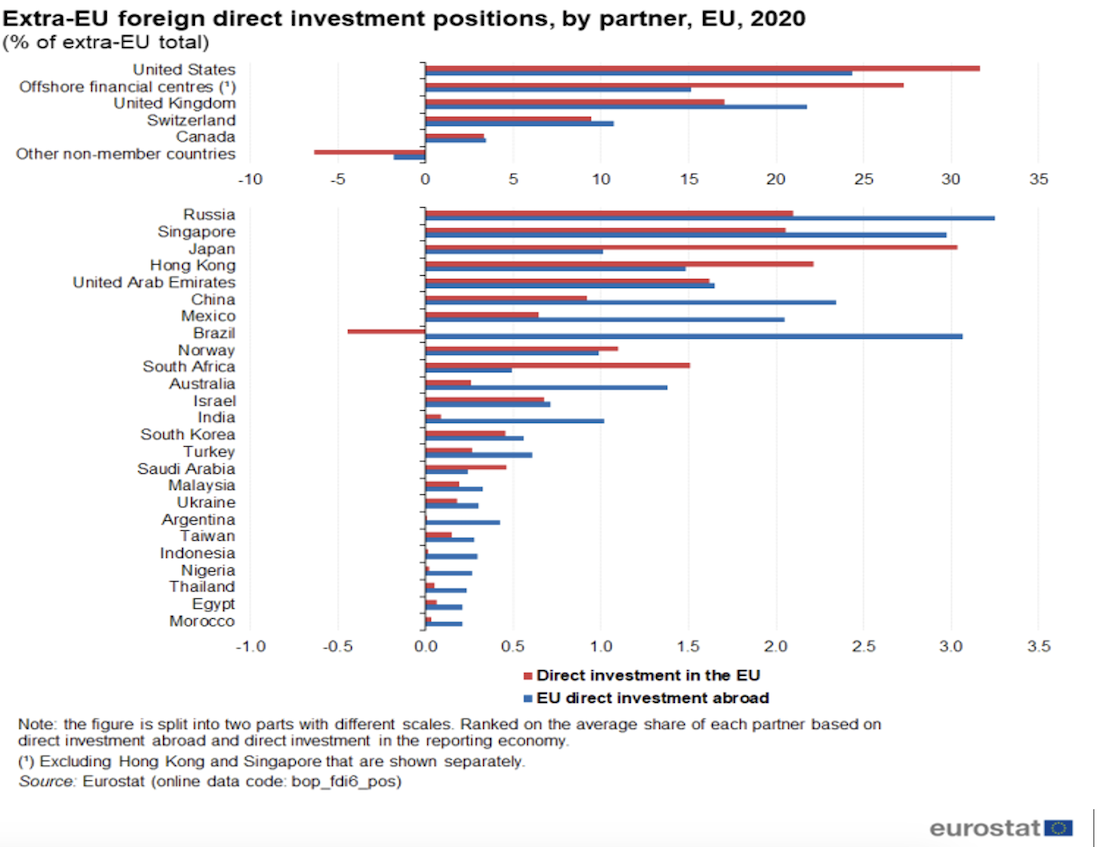

Compared to the trade imbalance between China and the EU, direct investments of China-EU are in a fluid state of balance. The EU direct investment inflow into China is far greater than China’s investment in the EU (see Figure 3). However, this situation has changed as many European companies complain about the lack of equal treatment with Chinese SOEs in most industries. With the influence of uncertainty in the global investment environment, the decline in EU FDI in China is evident. At the same time, Chinese direct investment in the EU increases. The situation of China-EU direct foreign investment is also directly reflected in the investment framework of the BRI. One of the reasons why the EU’s interest in and participation in BRI investment has declined is that EU direct investment in China is concentrated in manufacturing. The Chinese economy has stagnated for years, which is anticipated to continue as the population ages and urbanizes (“Global Economy to Slow Further Amid Signs of Resilience and China Re-opening” 2023). EU’s rate of return on China’s direct investment is not optimistic. As for the increase of Chinese direct investment in the EU, it is also a concern for the EU because the BRI targets high-tech industries (such as ICT).

The BRI’s financial resources are identified into five types: pure assistance, preferential loans, development financing, commercial loans, and different special funds. Development finance and special funds are essential for the five types of BRI infrastructure development and connectivity projects (Liu, Zhang, and Xiong 2020, 139-141). The primary funding sources for these BRI-participating projects are the Asian Infrastructure Investment Bank (AIIB), Chinese development banks, the Silk Road Fund, two large state-owned commercial banks, and the Shanghai Cooperation Organization Development Bank (SCODB). China leads most of the funding sources as the international financial institutions such as multilateral development banks dominated by Europe and the United States show little interest in infrastructure investment projects or attach many political and economic additional conditions in the investment process that are unacceptable to the country and region where the project is located, resulting in infrastructure investment. Financing could be used more effectively.

In several BRI nations, debt is a significant problem for future growth. Due to operational (e.g., travel restrictions or issues in supply chains) and financial constraints (e.g., challenges in financing or servicing debt), several investments in the BRI have had to be suspended, put on hold, or cancelled. According to the China Belt and Road Initiative (BRI) Investment Report H1 2022, over 50% of announced coal-fired power plants have been mothballed. Therefore, the allegation of a so-called “debt trap” spreads wide as some local projects are beyond the capacity of some countries, and it is easier for these countries to borrow too much debt to maintain the operation of the relevant projects. When they can not afford these debts, the capital chain breaks and the debts become bad (Zhang 2019, 321).

One worry about the BRI is that it could lead to debt traps (“EU-China Trade and Investment Relations in Challenging Times | Think Tank | European Parliament” 2020). The statistics on state debt levels along the BRI are insufficient as China has not yet reported how its loans are allocated among countries. Therefore, the situation of debt levels can only be based on the World Bank International debt statistics. On the one hand, China’s foreign debt increased dramatically from US$59 billion to US$696 billion, with a corresponding rise in trade credit, which is defined as the sum of Chinese importers’ prepayments and exporters’ account receivables in international trade, growing from US$67 billion in 2004 to US$560 billion in 2019 (SAFE, IIGF 2020).

On the other hand, a common consideration of the debt implication of the BRI is that emerging countries boost the economy by using public borrowing to support productive investment (John, Scott, and Gailyn 2018). China has seen increasing requests for debt relief from BRI countries over the past few months in the wake of COVID-19, which caused a sharp economic downturn. For example, Pakistan in April 2020 and the Republic of Zambia in October 2020 negotiated with China to delay the debt. For fiscal sustainability, the BRI’s projects may undermine the debt situation in borrowing countries (Hurley, Morris, and Portelance 2019, 139). The reasons why China provides massive loans are complicated. One is to maintain the local projects, especially the infrastructure construction. Another is the potential economic influence on these countries.

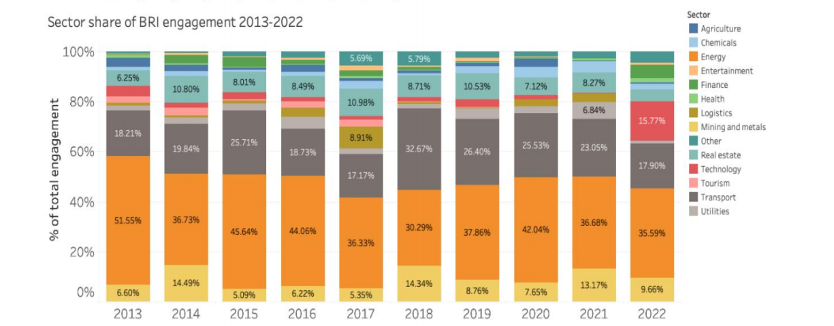

Among infrastructure projects, the most engaged sectors of China are transport and energy (see Figure 4). China’s first railway project in the European Union, the Hungary-Serbia Railway, runs from Belgrade, the capital of Serbia, to Budapest, the capital of Hungary, with a total length of 350 kilometers. Based on the China Belt and Road Portal, the Serbia section has a total length of 142.2 kilometers, which started construction in June 2018. It was constructed by a Chinese company and is scheduled to be completed in 2022. The Hungarian section is 159.4 kilometers long. In May 2019, the Sino-Hungarian enterprise consortium became the project’s main contractor through public bidding and signed the EPC contract. However, in 2017, this project was blocked by the European Union, and the European Commission investigated the Hungary-Serbia-Hungary railway project because “large-scale transportation projects must be subject to public bidding.” In Hungary, this project has also been opposed by many people. Some question the profitability of the project (Pepermans 2018, 194-196). Therefore, the Serbian-Hungarian Railway project’s Hungarian section has to be delayed until 2020.

Overall, the BRI is a double-edged sword for the EU with its opportunities and challenges. After ten years of development and accumulation, the BRI has experienced a stage from a newborn to an adult. The bottleneck and disadvantage are coming and exposing. It is still a significant economic initiation for China combined with Chinese diplomatic strategies. Furthermore, it is still attractive for the EU to connect the big Chinese and Eurasian markets. The BRI’s complicated levels and sectors make China adjust its structure and mechanism. However, the BRI’s aims, economic influence on the global trade and value chain, and potential geopolitical are still questions for the EU. The EU’s assessment and negotiation are ongoing.

The EU’s Global Strategy with Its Insufficient Capacity

The development of China-EU ties has been a slow and historical process. China and the European Economic Community formally reestablished diplomatic ties on May 6, 1975. In 1998, the EU released a document titled “Building a Comprehensive Partnership with China.” In 2001, the two sides established a comprehensive partnership. In 2003, China and the EU established a comprehensive strategic partnership. In 2014, China proposed to deepen the mutually beneficial and win-win China-EU comprehensive strategic partnership, fully implement the “China-EU Cooperation 2020 Strategic Plan”, create four significant partnerships of “peace, growth, reform, and civilization,” and further enhance the global influence of China-EU relations (“China’s policy paper on the EU: deepening the China-EU comprehensive strategic partnership of mutual benefit and win-win results” 2014).

Economic diplomacy is a primary content and significant characteristic of China-EU relations. It is also the central external expression of the EU’s presence on the global stage. In many respects, the external policy activities of the EU are dominated by economic considerations and the use of economic instruments in a broad sense (Smith 2014, 36). Establishing diplomatic relations with the European Community coincided with the beginning of China’s reform and opening up. The economic engagement then extended from the regular to high-level trade and economic dialogues between the EU and Chinese leaders and governments after China joined WTO in 2001. It also aligns with the multilateral frame pursued in EU economic diplomacy, such as the multilateral trade system in which China joined WTO.

The perception of the EU of China is associated with the EU’s economic diplomacy. It is based on three perspectives: the EU’s positioning on China, the EU’s economic pursuit and aim, and the different economic requirements within the EU. The first perspective of the EU’s positioning on China is changeable in different periods. From 2003 to 2012, the EU and China were regular economic partners, and their economic engagement mainly focused on trade. However, the dynamic trade growth reflected some extent the spontaneous development, and there is a lack of an efficient mechanism to lead and economic cooperation (Chen, Xin 2014, 44). Furthermore, the trade deficit has consistently kept widening since 2011. The EU consistently maintained a trade imbalance with China, which peaked in 2021 at €249 billion after reaching €129 billion in 2011 (See Figure 5).

The EU is aware that the development of the Chinese economy is growing beyond its evaluation during the relationship. China is now the EU’s second biggest trading partner behind the United States, and the EU is China’s biggest trading partner. In 2019, the EU-China – A strategic outlook published by the European Commission considered China no longer a developing country and regarded it as a significant global actor, a cooperation partner in different areas, an economic competitor, and a systematic rival in global governance. Moreover, China’s assertive foreign policy, such as the investment strategy including the Belt and Road Initiative, poses serious political, economic, technological, and security to the EU (The European Parliament A New EU-China Strategy 2021). The shift in the positioning of the EU on China is primarily because of the robust economic strength and its enlarging potential political influence on the global political economy.

The second perspective is the EU’s economic pursuit and aim. The distinctive economic power of the EU is an efficient instrument to influence and shape the global economy, such as promoting global trade as more liberal and diverse and dedicated to enhancing international norms as its core values and responsibility. The significant pursuit and aim of the EU are to defend and promote the EU’s core values (universal values, international norms, and human rights). The trade deficit makes the EU realize that the existing cooperation with China has challenges and limitations. Especially the potential loss of technology and intellectual rights in the trade, the difficulty of entering the Chinese market, and an unfair playing field. The EU seeks more balanced and reciprocal conditions governing the economic relationship.

The last perspective is the different economic requirements within the EU. For the EU, speaking as one voice is becoming problematic. As internal fragmentation is revealed, the imbalanced development and different interests of individual EU members ask for different requirements. For example, the northern countries are asking for a more liberal economy, while the southern, central, and eastern countries are becoming protectionist. The most important feature of the Northern European political economy model is its openness to economic globalization, particularly trade. Finland is a country known for its strong tradition of free trade.

While southern, central, and eastern states like Italy, Hungary, and Poland remain less open to international markets yet offer strong employment protection for the system’s “insiders.” (Hopkin 2004) One primary reason is the impact of the European debt crisis and Eurozone crisis that recovered slowly, resulting in a situation in which the EU members find common interests and political demands difficult (Chang and Pieke 2018, 321-322). Many researchers and observers first thought the recovery of the EU should be completed rapidly according to the EU’s historical success and economic structure, therefore, they were optimistic about the future of the EU (Chen 2012).

However, the EU is incapable of retaining its internal stability and solving problems effectively with its economic power after the refugee crisis, the Brexit vote in 2016, and the terrorist attack in Brussels. That causes an internal question about the EU’s capability and shifts the Chinese view of the EU. In 2012, the 16+1 platform was launched by China as an economic cooperation and coordination mechanism with the central and eastern European countries of infrastructure, commerce, and industrial capacity (Long, Jing 2014, 52). Furthermore, Hungary, Greece, and Croatia disapproved of the joint EU statement on the Permanent Court of Arbitration verdict on the South China Sea conflict in 2016. These events make the internal disagreements and differences of the EU more visible.

Exploring the fundamental reasons behind the disagreements and fragmentation within the EU can not only be based on economic strength and diplomacy. As the EU and China tend to seek more effective global influence, the perception of the EU on China should consider its political relations and aims. It mainly discusses two aspects: internal cohesiveness and external effectiveness of the EU in global governance, and how the EU implements its global strategy effectively—transforming the EU into a more effective geopolitical actor. Multilateralism and global climate change are the priorities of the EU after the Financial Crisis (“Priorities of the European Union 2019-2024 | European Union,” n.d.). To some extent, the BRI threatens the EU’s presence in Eurasia. It undermines the engagement of the EU in the market as many countries, including individual EU members, signed a bilateral investment agreement with China. The favorable and simpler policies of market access and investment are a powerful economic instrument these countries use to attract Chinese investment, which also considerably harms the EU’s economic influence on Eurasia and internal unity. The insufficient influence of the EU’s economy constrains its geopolitical power.

Facing global problems requires China’s participation and cooperation to enhance the EU’s global leadership and influence. It has gradually become a consensus: a more cohesive EU can play a more effective role in global governance. Many researchers have assumed that the cohesive and united EU is more assertive and effective in global governance (Niemann and Bretherton 2013, 270-272). Evaluating the EU’s external actions in this logic, the facts that the EU has not achieved its political goals. For internal cohesiveness, an individual member asks for different economic development requirements because of the slow economic recovery described above. Therefore, the various economic demands reflect each member’s political actions toward the EU and China. Hungary, as one of the participants of the 16+1 platform and BRI, over the years, has blocked the EU’s initiatives and statements seeking to hold China accountable—in 2016 on the South China Sea, in 2017 on the torture of detained Chinese lawyers, or in 2018 on human rights. Some researchers think Hungary is China’s “Trojan Horse,” which threatens the EU’s ideological, policy, and internal cohesiveness to counter China (Venne 2022).

For external actions, the EU’s outstanding ability is the soft power while it can not adapt well to reality. This problem has been seen in A Global Strategy for the European Union’s Foreign and Security Policy (2016), the Vice-President of the European Commission, Federica Mogherini, proposed that the EU should engage in a practical and principled way, sharing global responsibilities with our partners and contributing to their strengths (“A Global Strategy for the European Union’s Foreign and Security Policy,” 2019). A strong example is the enlargement of the EU in recent years, such as the participation of Croatia. However, it is mainly based on the EU’s economic attractiveness.

Overall, the perception of the EU of China is a continuously complicated and compromised perspective, just like the state of China-EU relations. Because the fundamental and persistent differences in values, policy, and practice remain, both sides have no choice but to deepen cooperation in light of their shared interests, deep interconnectedness, and contemporary geopolitical and international realities (Chang and Pieke 2018b, 327-328). Constructive engagement is based on the comprehensive, objective, and critical assessment of Chinese initiatives and actions, like the Belt and Road Initiative and cooperation with China on green energy, technology, and climate. Achieving economic and political goals for the EU is the foremost, and seeking similarities and connections with Chinese diplomatic aims is a common issue of China-EU relations.

Conclusion

The ten-year dynamic development of the Belt and Road Initiative is still on the road despite the issues in trade, investment and finance, and infrastructure construction. The EU is concerned about the intention behind Chinese foreign actions, such as the economic arrangement of the Belt and Road Initiative. Some EU diplomats argue that this initiative has a political influence on the unity of the EU, and it may cause severe “divide and rule” within the EU. However, some EU members argue that it is an alternative to recover the EU’s economy after the Crisis and Covid-19. While the EU and China are still negotiating, the situation is still an argument with no final result. With the new EU strategic outlook released in 2019, it is clear that the EU is adopting a more pragmatic strategy to deal with the changeable and complicated international situation. The game between China and the US may influence the international order deeply, therefore, the prudence of the EU seems to be a more appropriate and compromising strategy for dealing with China.

Figures

Figure 1: EU Trade in Goods with China, 2012–2022

Figure 2: EU Trade Balance of Goods with China, 2022

Figure 3: Extra-EU Foreign Direct Investment Positions, by partner, EU, 2020

Figure 4: Sector Share of BRI Engagement, 2013-2022

Figure 5: EU trade in goods with China, 2011-2021.

Source: ext_st_eu27_2020sitc

References

Bashir, M.A. 2021. “Evaluation of One Belt One Road publications: a bibliometric and literature review analysis.” Environmental Science and Pollution Research 28 (28): 16–30. https://doi.org/10.1007/s11356-021-14621-y

Chang, V.H.S. and Pieke, F.N. 2018. “Europe’s engagement with China: shifting Chinese views of the EU and the EU-China relationship.” Asia Europe Journal 16 (4): 317–331. https://doi.org/10.1007/s10308-017-0499-9

Chen, Z. 2012. “Europe as a Global Player: A View from China.” Perspectives: Review of International Affairs 20, (2).

China Belt and Road Portal. 2022. “International Cooperation, Country Profiles. Chinese Foreign Ministry.” [中国一带一路网 (2022) 国际合作,各国概要. 中华人民共和国外交部]. https://www.yidaiyilu.gov.cn/info/iList.jsp?cat_id=10037

Canning, D. and Pedroni, P. 2008. “Infrastructure, Long-Run Economic Growth and Casualty Tests For Cointegrated Panels.” The Manchester School 76 (5): 504–527. https://doi.org/10.1111/j.1467-9957.2008.01073.x.

Christoph, N. 2022. “China Belt and Road Initiative (BRI) Investment Report H1 2022.” Green Finance & Development Center, FISF Fudan University.

Da Conceição-Heldt, E. and Meunier, S. 2014. “Speaking with a single voice: internal cohesiveness and external effectiveness of the EU in global governance.” Journal of European Public Policy 21 (7): 961–979. https://doi.org/10.1080/13501763.2014.913219

European Parliament Think Tank 2020. “EU-China trade and investment relations in challenging times | Think Tank | European Parliament.” https://www.europarl.europa.eu/thinktank/en/document/EXPO_STU(2020)603492

García Herrero, A. and J. Xu. 2016. “China’s Belt and Road initiative: can Europe expect trade gains?” Bruegel, working paper, 05. https://www.bruegel.org/wpcontent/uploads/2016/09/WP-05-2016.pdf

General Office of the State Council of the People’s Republic of China. 2021. “The 14th Five-Year Plan for National Economic and Social Development of the People’s Republic of China and Outline of Long-term Goals for 2035.” https://www.ndrc.gov.cn/xxgk/zcfb/ghwb/202103/P020210323538797779059.pdf

Hurley, J., Morris, S.C. and Portelance, G. 2019. “Examining the debt implications of the Belt and Road Initiative from a policy perspective.” Journal of Infrastructure, Policy and Development 3, (1):139. https://doi.org/10.24294/jipd.v3i1.1123

IMF 2023. “Global Economy to Slow Further Amid Signs of Resilience and China Re-opening.” https://www.imf.org/en/Blogs/Articles/2023/01/30/global-economy-to-slow-further-amid-signs-of-resilience-and-china-re-opening.

John Hurley, Scott Morris, and Gailyn Portelance. 2018. “Examining the Debt Implications of the Belt and Road Initiative from a Policy Perspective. CGD Policy Paper. Washington, DC: Center for Global Development. ” https://www.cgdev.org/publication/examining-debt-implications-belt-and-roadinitiative-policy-perspective

Liu, W., Zhang, Y. and Xiong, W. 2020. “Financing the Belt and Road Initiative.” Eurasian Geography and Economics 61 (2): 137–145. https://doi.org/10.1080/15387216.2020.1716822.

Lai, K.P.Y., Lin, S. and Sidaway, J.D. 2020. “Financing the Belt and Road Initiative (BRI): research agendas beyond the ‘debt-trap’ discourse.” Eurasian Geography and Economics 61 (2): 109–124. https://doi.org/10.1080/15387216.2020.1726787.

Li, X.-T. 2016. “Applying offensive realism to the rise of China: structural incentives and Chinese diplomacy toward the neighboring states.” International Relations of the Asia-Pacific [Preprint]. https://doi.org/10.1093/irap/lcv019

Long and Jing. 2014. “Relations between China and CEE Countries: Development, Challenges and Recommendations.” China International Studies, (5):44–60. http://www.cqvip.com/QK/88468X/201405/662835300.html

Ministry of Foreign Affairs of the People’s Republic of China. 2021. “Firmly uphold and practice multilateralism and insist on promoting the building of a community with a shared future for mankind.” https://www.mfa.gov.cn/web/ziliao_674904/zyjh_674906/202102/t20210221_9870757.shtml

Minister of Foreign Affairs of the People’s Republic of China. 2023. “Relations between China and the European Union.” [中华人民共和国外交部(2023)中国同欧盟的关系]. https://www.fmprc.gov.cn/web/gjhdq_676201/gjhdqzz_681964/1206_679930/sbgx_679934

Minister of Foreign Affairs of the People’s Republic of China. 2014. “China’s policy paper on the EU: deepening the China-EU comprehensive strategic partnership of mutual benefit and win-win results.” [中国对欧盟政策文件:深化互利共赢的中欧全面战略伙伴关系, 中华人民共和国外交部]. https://www.mfa.gov.cn/web/gjhdq_676201/gjhdqzz_681964/1206_679930/1207_679942/201404/t20140402_9389344.shtml

Niemann, A. and Bretherton, C. 2013. “EU external policy at the crossroads: The challenge of actorness and effectiveness.” International Relations 27 (3): 261–275. https://doi.org/10.1177/0047117813497306.

OECD. 2018. “The Belt and Road Initiative in the global trade, investment and finance landscape.” OECD Business and Finance Outlook 2018, OECD Publishing, Paris. https://doi.org/10.1787/bus_fin_out-2018-6-en

Publications Office of the European Union. 2019. “JOIN/2019/5 final, JOINT COMMUNICATION TO THE EUROPEAN PARLIAMENT, THE EUROPEAN COUNCIL AND THE COUNCIL EU-China – A strategic outlook. “ https://op.europa.eu/en/publication-detail/-/publication/3a5bf913-45af-11e9-a8ed-01aa75ed71a1/language-en

Pepermans, A. 2018. “China’s 16+1 and Belt and Road Initiative in Central and Eastern Europe: economic and political influence at a cheap price.” Journal of Contemporary Central and Eastern Europe 26 (2–3): 181–203. https://doi.org/10.1080/25739638.2018.1515862.

Smith, M.S. 2014. “EU-China relations and the limits of economic diplomacy.” Asia Europe Journal 12 (1–2): 35–48. https://doi.org/10.1007/s10308-014-0374-x

The European Parliament. 2018. “The Juncker Commission’s ten priorities.” https://www.europarl.europa.eu/RegData/etudes/STUD/2018/625176/EPRS_STU(2018)625176_EN.pdf

The European Union External Action. 2019. “A Global Strategy for the European Union’s Foreign and Security Policy.” https://www.eeas.europa.eu/eeas/global-strategy-european-unions-foreign-and-security-policy_en

The European Parliament 2021. “A New EU-China Strategy.” https://www.europarl.europa.eu/doceo/document/TA-9-2021-0382_EN.html

UNCTAD. 2013. “Global value chains: Investment and trade for development.” World Investment Report. https://doi.org/10.18356/f045c54c-en

Zhang, Y. 2019. “Third-party market cooperation under the Belt and Road Initiative: progress, challenges, and recommendations.” China International Strategy Review 1 (2): 310–329. https://doi.org/10.1007/s42533-019-00026-7

Further Reading on E-International Relations

- China’s Belt and Road Initiative: Debt Trap or Soft Power Catalyst?

- Opinion – The Impact of China’s Belt and Road Initiative on Central Asia and the South Caucasus

- Opinion – China’s Belt and Road Initiative: Pragmatism over Morals?

- Deciphering the Belt and Road Initiative

- Assessing Securitization: China’s Belt and Road Initiative

- Can China Link the Belt and Road Initiative by Rail?