1 Introduction

‘I will examine the way corruption was lived, the way it was interpreted, perceived and understood by those concerned and by the governement. This will reveal that, for the men of the time, corruption was not so much an economic or political issue as a moral problem.’

(Jean-Claude Waquet, Corruption: Ethics and Power in Florence, 1600—1770)

As Jean-Claude Waquet was already able to point out regarding bureaucracy in the Florence of the 17th and 18th century, trying to understand corruption merely in terms of politics and economics and thereby ignoring other important dimensions is restricting. Regardless, today’s anticorruption consensus[1] in interplay with academic research throughout the recent decades has led to an understanding of corruption in the discipline of International Political Economy (henceforth IPE), which largely neglects psychological, cultural and moral aspects that should be incorporated in the concept. What Waquet saw as a moral problem as opposed to a mere politico-economic one, is in fact part of such an interdisciplinary approach, necessary to understand the social fabric in which corruption occurs.

With regards to the above problem the concern of this paper is twofold. First, I claim that the conventional understanding of corruption in IPE is limited and that it is therefore required to improve this understanding through the insights that economic experiments have brought forward. Different experiments offer explanations on exactly those social, psychological, cultural or moral aspects and have very significant policy implications, ranging from the involvement of women in public positions to the advantages of combined accountability of public servants. As a by-product of the analysis aspects of corruption are revealed that cannot be covered or have not yet been brought out in economic experiments, which suggests possible new avenues of research. Such is for instance a decrease in public educational and healthcare spending, both of which are typical consequences of corruption. Second, I shall show that the way corruption is conventionally measured is often just as much insufficient, if not poor, and that incorporating economic experiments into corruption measurement is therefore crucial.

Both points fill a significant gap in the existing literature. To my knowledge, there is neither an up-to-date fusion[2] of what I call a conventional understanding of corruption and the improved understanding resulting out of the consideration of economic experiments, nor is there such fusion when it comes to measuring corruption. The paper’s analysis incorporates the results of most recent unpublished experiments[3], such as Campos-Ortiz (2010) and Serra (2010).

In order to arrive at the above improvement-suggesting conclusions, the following steps are necessary. It is important to note that the vast majority of corruption related literature discusses the matter without clearly defining what corruption actually is. For that reason, chapter 2 is structured in such way that it leads up to a definition that attempts to be less ambiguous than most definitions in the literature[4]. First, it will set out an economic foundation that sees corruption as a particular form of (negative) externality. It describes the three parties that make for a corrupt act, namely benefactor, beneficiary and the disadvantaged. Second, a social, cultural and political framework will describe various facets of a conventional understanding of corruption. The sociological angle of this section is not part of the study of corruption in IPE. However, it presents the reader however with the necessary background for some of the sociological findings and implications of economic experiments in chapter 3. Third, I define corruption based on the provided background precisely as an immoral and measurable transaction between three parties, and with the involvement of public office[5]. Forth, I will give an account of the not always separable causes and consequences of corruption.

In chapter 3 it is then necessary to conduct an analysis of various insights from experimental economics. First, I will briefly illustrate the methodology of economic experiments. Second, I will illustrate the conclusions and policy implications that can be drawn, considering almost all corruption related experiments that have been conducted to date, and covering the areas of externalities, reciprocity, culture, epidemic nature, regulation and governance (detection, penalties etc.), social facts, bribery price, bureaucrats pay and (income) inequality. The provided insights shall serve to suggest how the current understanding of corruption in IPE should be deepened and broadened.

Taken together, chapters 2 and 3 will demonstrate on the one hand the limitations of a conventional understanding of corruption and on the other exhibit the benefits and the character of an improved understanding of the matter through the analysis of experimental findings. While conventional theory speculates about the potential effects of kinds of regimes, kinds of regulation, cultural differences, the influencing factors of the price of bribery etc., experimental evidence is able to state with exactness what effect the increase of penalty has, what the exclusive cultural differences of corruption inclinations between countries are, or at what level officials’ pay is more efficient when considering that the raise of bureaucrats’ salaries can only reduce but not eradicate corrupt practices. In other words, economic experiments do not only add to conventional theory by revealing ‘behavioural patterns’, but they are able to make significant statements about its validity.

In chapter 4 I will, first, present the hazards of conventional methodology regarding corruption measurement and, second, point out the benefits of experimental assessment. I suggest that Transparency International’s (TI) Corruption Perception Index (CPI) as today’s most credible way of measuring corruption should be paired with simple experimental bribery games to make for a more robust tool of measurement. Traditional assessment of corruption levels takes into account surveys on subjective perception or statistical data about corruption cases that have raised public awareness. Only experiments are able to detect behavioural patterns or thresholds of inclinations to engage in or tolerate corruption. Experiments can contradict or verify current theory and indices, and would ideally always complement them.fu

In a conclusion I will summarise the findings of the paper and suggest what would be worthwhile researching in future.

2 Conventional Conceptualisation of Corruption

In International Political Economy the conception of corruption is primarily based on a politico-economic understanding of its causes and consequences. This chapter is concerned not only with the illustration of those conceptions but it also offers insights into social and moral aspects of corruption as well as an explicit definition of it.

2.1 Economic Foundation

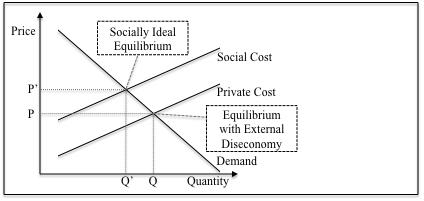

In a free-market economy there is a market for (nearly) everything, and hence demand and supply for every good and service. Diseconomies occur only in those cases in which the price of a good or service is not determined by the natural equilibrium of supply and demand, but instead by market power—the ability of an economic agent to influence or set prices because of an advantageous position—or by the incorrect/impossible assessment of the costs of a good or service, as is the case with externalities. The latter are those costs that occur external to the causer or that at least in part are carried by others, that is to say in most cases by the rest of society. Imagine the example of a firm that bribes a civil servant, which enables them to buy licences for water pollution and thereby exceed the legal limit. The briber makes a payoff to the bribee in order to be able to further pollute, which stands in conflict with the law and the interest of society. As a result, both, briber and bribee benefit and, in this case, society bears the costs of the pollution. Corruption produces here technically a negative externality. The latter describes a market external to the free market, confined by regulation. Precisely, it is the divergence between private and social costs that, as shown in the graph below, lead to

economic deficiencies (Begg, 2008, p.267).

Figure 1, corruption as a negative externality.

This is a narrow economic definition of corruption, reflecting a three-way relationship between benefactor, beneficiary, and the disadvantaged. It is an important technical basis. In comparison and to make a connection to experimental economics, economic experiments, such as Abbink et al, are based on the same ‘essential characteristics of corruption’ (2002): The ‘reciprocity’ of firm and civil servant outside the law and the negative diseconomy that society is subjected to.

This thought is however not as clean-cut as it first seems. Also regulation represents a variable, upon which efficiency is strongly dependent. It has been argued that a certain, small amount of corruption, known as ‘greasing’, is beneficial to economic efficiency (cf. Rose-Ackerman, 2006). Any regulation, for instance in form of taxation, tariffs, and trade restrictions is even in its slightest form simultaneously a disruptive factor to efficiency. In that case, the effect of efficiency increasing ‘greasing’ would become a positive externality. Thus society benefits from positive welfare effects. There is a fine line of efficiency increasing forms of ‘greasing’ vis-à-vis inefficient economic distortion through corruption. The question of where to draw that line is however not so much an economic one as it is one of morality and from a technical perspective one of optimal regulation[6]. This paper regards corruption as immoral regardless of potential (but unlikely) positive effects, which removes the centre of attention from this balancing act. Thus, to lay the foundations of the corruption concept on its nature as an externality by way of the above derivation is sufficient. It provides groundwork for both, the definition of corruption this chapter will settle for, and the way corruption is congruently represented in economic experiments in chapter 3. The next section shall examine the social and political background of the corruption concept.

2.2 Social and Political Characterisation

Beginning with the social aspect of corruption, in connection with the previous section, it is useful to turn to Khondker’s sociological corruption analysis. It is mainly based on Alatas’ findings (Khondker, 2006; Alatas, 1991) who was the first sociologist to tackle corruption in his subject.

Although Alatas goes as far as denying that corruption could in any case be advantageous, for instance in form of economic ‘greasing’, his conclusion of corruption as a moral bad is satisfactory. As Khondker summarises, ‘[c]orruption, like crime, is a threat to society and should be dealt with as such. … Alatas was examining corruption not just as a problem of governance but sought to view it broadly as a social phenomenon and to explain it in terms of other “social facts”’ (Khondker, 2006, pp.30,33). This view, as shall become clear throughout this paper, is one that is largely neglected by current corruption analyses in politics and economics, and one that ought to be incorporated into a thorough understanding of the matter[7].

Understanding the sociology of corruption is a matter of studying its moral aspects. It thus involves the time-honoured question of universalism versus relativism. Alatas’ view is universalistic and rejects any form of moral relativism. Taking differences in culture as an example he is reluctant to accept such differences as reasons or ‘excuses’ for whether corruption should be tolerated more or less in different countries.

This is a critical issue. As chapter 3 shall demonstrate, both toleration and engagement in corruption differ[8] as a matter of fact and the reasons for that are explained neither just sociologically, nor solely economically or politically. As I shall argue, those reasons can only be captured through an interdisciplinary analysis that considers the findings of economic experiments.

Khondker points out the significance of a lucid definition for ‘if we … start off with the premise of relativism, we could argue endlessly that what is corruption from your point of view is an integral part of my cultural practice’ (Khondker, 2006, p.36). In part this confirms how important it is for any paper on corruption to present a clear definition of what it actually is. On the other hand it is a challenge for producing such definition. Space does not allow for a more thorough examination of this problem of moral philosophy. I find however that it will suffice for a sociological introduction to consider that corruption is immoral, as simply reflected in its etymology. According to it ‘corrupt’ stems from the Latin word corrumpere, which refers to ‘destroying’ and ‘spoiling’ or ‘seducing’ and ‘bribing’ (Harper, 2010)[9].

There is also a cultural dimension to the morality of corruption. For instance, to decide that habits in a certain culture are wrong by making a law that stands in conflict with them is problematic. To come to terms with these kinds of challenges it is necessary that the corruption definition of the subsequent section recognises two things; first, that there are cultural differences in corruption toleration and inclination to engage in it; second, that it remains independent enough, and thus, as Khondker warns, refrains from being ‘Western science dressed up as universalism’ (Khondker, 2006, p.36).

That it is useful to understand the level of corruption as dependent on both, socio-cultural circumstances, and politico-economic factors, is also shown by Jörg Wiegratz’ survey-based research on Uganda (2010). He finds that neoliberal reforms since the 1980’s have changed the moral of the Ugandan society for the worse. Forcing, what he calls, ‘low-empathy’, ‘rational’ neoliberal development on to the population has led to a decrease of trust and an increase of malpractice and cheating in trade both locally and on higher public official levels. On the politico-economic side, Wiegratz describes a process in which reforms have led to an exaltation of multinational companies, which was accompanied by a worsening of farmers’ bargaining positions and an increased amount of intermediaries, cutting off their own margins. In society, the reforms have modified moral codes and contested old notions of moral ‘decency’. The demands of this ‘fake’ neoliberalism have forced new trade relationships into place, which, by way of their negative economic effect have led to a loss of trust. This process, says Wiegratz, is one of demoralisation; the loss of empathy in society and continuous disappointment in trade relationships fosters corruption and malpractice. Further, his observation seems to testify to the epidemic nature of corruption[10].

Wiegratz’s argument is one that advocates the immorality of corruption. However, by describing the interplay of socio-cultural and politico-economic factors in the case of Uganda he also concludes that, in opposition to neoliberal thought, less regulation is worse for a country’s economy and society (2010). This leads to the political side of understanding corruption: first of all, the question of governance and regulation.

In reference to the fine line between corruption as a negative (and respectively positive) externality, governance and regulation can be illustrated by dint of two dimensions; first, more and less regulation, and, second, good and bad regulation. Wiegratz’ supposed contradiction between neoliberal alleged pro-growth deregulation and his findings that the same lead to an overall worsening of the socio-economic standing of Uganda’s population is then not so much of a riddle. Bad regulation leads to worse outcomes but less regulation (deregulation) can do, too. For that reason a certain amount of good regulation is key to reduce corruption and ultimately foster economic growth and development, alleviate of poverty etc[11]. Regulation has thus to settle at a point where it is optimal in a sense that corruption does not become the more efficient detour. Yet it has to be tweaked in such way that it prevents unfair bargaining positions of the economically powerful, syndication between multinational corporations (MNC) and government officials etc. The concept of governance is another variable that makes a unanimously acceptable definition impossible.

Rose-Ackerman contends that ‘corruption occurs at the interface of public and private sectors’ (1997, pp., 31). In other words, it is the undesirable result of uneven positions between political power, economic power, and the power of the public. Michael Johnston offers two useful political dimensions, which illustrate how those relations lead to political corruption (1997). The first he describes as a balance between the accessibility of political elites by public and private economy vis-à-vis the autonomy of political elites. In other words, both private economy and public should have substantial political leverage but the government should remain in the position to execute its regulative powers effectively. The second dimension is a wealth-power balance. It suggests that economic interests should not inhibit political decisions, and accordingly, that political power should not be exchangeable for economic power.

Johnston’s account neglects however an international perspective which is crucial for this paper. While there is no evidence that globalisation has led to an increase in corruption over the past decade, it is out of question that it now takes place in an international arena (Jain, 2001, p.103; Tanzi, 1998). Such an international perspective is concerned with the role of multinational corporations, national and international regulation efforts, international institutions, and the global media, all of which are part of a joint anti-corruption discourse.

Multinational corporations are thought to have gone from briber to corruption antagonist, as protectionism is no longer an obstacle in foreign markets. Firstly, Krastev asserts that this is a consequence of a competitive global economy in which protectionism leads to harmful economic inefficiency. For governments it has become virtually impossible to relinquish foreign direct investment (FDI) or loans from the International Monetary Fund (IMF). Secondly, as I think Wiegratz meant to refer to when speaking of glorification of foreign companies in Uganda, global brands become increasingly dominant paradigms for all layers of society in both developing and emerging economies[12]. This, best understood as an artificial commercial culture imported initially through media, is the ideal humus for MNCs to gain a foothold. Accordingly, from a business perspective, bribe is increasingly seen as a threat as opposed to a means to success in a foreign market.

The latter finds support also when considering that many large MNCs are based in the United States. US governments have unavailingly been looking for international support when the Foreign Corrupt Practices Act (FCPA) was passed by the US congress in 1977 (Walter & Sen, 2009). As under that law US companies cannot be involved in foreign bribery it placed them into disadvantage. Caught in a prisoner’s dilemma MNCs in many developing countries were forced to engage in payoffs as refusal to do so meant loss of market share. For that reason and with the priority of their own economy in mind legislation in Western economies has long been contradictory. Germany praised itself as one of the least corrupt countries but was the last country to illegalise tax-deductibility of foreign corporate bribery (Glynn et al., 1997). Finally, in 1997 the OECD Anti-Bribery Convention was for the abolishment of tax deductibility of bribery (Abbink et al., 2002).

Bretton-Woods institutions had their own motivations to defy corruption. As much of their task has been to avert the threat of a communist takeover in developing countries the required upholding of corrupt dictatorships was no longer necessary after the decay of the Soviet Union. With the emergence of anti-corruption NGO Transparency International (TI) and the foreign politics of anti-corruption on the part of the US and other Western nations, World Bank and IMF were forced to provide transparency regarding the way they conducted their business (Krastev, 2004).

With successful TI efforts to insist on institutional amendments such as the case of Germany in 1995, anti-corruption schemes went straight to the top of the agenda of IMF and World Bank as well as MNCs and Western governments. Dani Rodrik and James Rauch point out that corruption rhetoric changed from ‘an “economic development” problem into an “international trade and investment” problem. We in the industrial countries believe “their” corruption hurts us’ (Rodrik & Rauch, 1997, p.110). According to Krastev these dynamics have led to an anti-corruption consensus between the above parties that is to be viewed critically. He mentions later that ‘[a]nticorruption rhetoric turned out to be the major justification for … neoliberal policies in the field of economy and governing’ (Krastev, 2004, p.35). As this paper aims to shed new light on the way corruption is understood in IPE this is an important criticism of the current paradigm.

The influence of the media on a global scale becomes increasingly significant, especially with regards to the rapid spread of the Internet as an unprecedented platform for news and communication, which seems to be largely neglected by scholars who write about corruption. Krastev emphasises that today’s focus on corruption must be owed to either ‘the increase in corruption or … the increase of corruption visibility’. The immediate international awareness of corrupt practices caused by an interplay of shock-appetent mass-audiences and rigorous responses by the media supports the latter conclusion. Although transparency, as in line with the global anti-corruption consensus and TI’s agenda, is certainly desirable, it concurrently could foster the potential risk of corruption to ‘delegitimize one’s antagonists’.

The different players in the international corruption debate illustrated in the recent paragraphs provide further background for experimental insights later on. The following definition is based on the last two sections.

2.3 Defining Corruption

My definition hinges on four conditions that have to be met so that a case of malpractice may qualify as corruption. I will explain in this section why it requires a immoral and measurable transaction between three parties, the involvement of public office, and lastly the cause of a negative externality to a third party such as society.

It is best to begin with the economic derivation introduced earlier on. According to it, a corrupt act requires three parties to qualify as such. That is, a corruptor, a corruptee and a disadvantaged party; One party must involve the abuse of public power, in other words the acceptance of or demand for payoff on the part of any kind of public official/s; The second party, that is a private person, a corporate body or a representative or even another public official (such as a judiciary executive, a police officer etc.), is either forced to or seeks to make a payoff to the first party; the third party as the owner of the common good, in most cases society, bears the external costs of the corrupt act. In other words, the corrupt act benefits two parties at the cost of a third party, according to zero-sum theory[13]. As mentioned in the introduction, this definition is concerned with public corruption, not private corruption.

Slight forms of corruption such as ‘grease money’ are a grey area. As only in the hypothetical case of an entirely free economy with no regulation perfect efficiency could be achieved, ‘greasing’ can in slight forms smoothen the regulative edges of a market. Contrarily, Kaufmann and Wei’s surveys showed that the costs of bribe plus ‘management time wasted with bureaucracy, regulatory burden, and cost of capital’ are on average higher than the actual benefits through bribe, which implies that even the slightest form of corruption is economically damaging (Kaufmann & Wei, 1999). Whichever the case, the moral conflict arises between the wrongdoing that nepotism is and what in ethics is referred to as special obligations[14]. As however there is no clear distinction between private relations, business relations and malicious corrupting relations between economic agents, it stands to reason to denote malfeasance, that is moral and social trespass embodied by trespass of the law, as the starting point of corrupt behaviour.

The above delineation aims to be an exact one and a strict one. However, as Miller states, ‘there are at least as many forms of corruption as there are human institutions that might become corrupted’ (Miller, 2005). Although corruption and other (economic) kinds of crime are often strongly interlinked, it is important to see that this definition excludes those other potentially criminal activities, that is to say, it needs to divide rigorously between forms of corruption that are captured by the above definition and those that fall out of it. As Ian Senior recognises, theft for instance involves only two parties. Whether it is petty crimes like the theft of a bicycle or grand scale theft such as kleptocracy, where thieves accroach ‘public or corporate assets in favour of themselves, it fails to include either the gains of a second party or the loss experienced by disadvantaged stakeholders (Senior, 2006, pp.30-31). The same applies for fraud with the irrelevant difference that as a distinct form of theft it is mostly concerned with intangible goods and the involvement of false information. Tax evasion is again a similar case. It is even distinctly different from corruption as it involves working strategically against or around policy and public officials enforcing it, that is to say it does not seek to pay for illegal approval. Insider dealing is a slightly more complex case. Although three parties are involved, it still does not necessarily classify as corruption. Only if corruptor or corruptee holds public office and if actual benefits beyond mere collusion are exchanged it could grade as corruption. Finally, the challenge is to settle on a threshold for what counts as a corrupt payoff and what is merely collusion. The plain exchange of information is nothing objectionable but corruption is not necessarily defined only monetarily. Here, it makes sense to call a corrupt act one that is based on either monetary payoff or other tangible ways of making a payoff, such as donations.

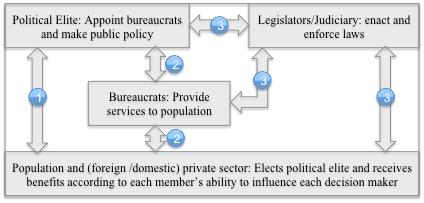

There are then four significant ways left in which corruption can occur. Figure 2 illustrates these relations:

Figure 2, Three relations of corruption (Jain, 2001, pp.74, significantly altered)

The relation between private sector and political elite is known as grand corruption. This is the most harmful form of corruption for the population of a country when it comes to poverty, development etc (Eigen, 2010). The second type of relation ‘refers to corrupt acts of the appointed bureaucrats in their dealings with either their superiors (the political elite) or with the public’ (Jain, 2001, p.75). Corrupt practices to buy legal decisions are illustrated by the third type of relation.

Ultimately, corruption can only be defined in a way it can also be measured. As this paper’s second aim is to work out in what way experimental economics improve and facilitate the way corruption can be measured, this matter will be dealt with in chapter 4. Both, traditional methodology, and experimental methodology of corruption measurement will have to conform to the definition set out in this section.

2.4 Causes and Consequences of Corruption

Following the earlier thought that corruption has a tendency to spread, it is safe to say that its causes and consequences are not always distinguishable from each other (cf. Jain, 2001, and Mauro, 1997); one circumstance might trigger corruption in a certain area which could then again spark off corruption in another area etc. Notwithstanding, I shall try to briefly state what to date is understood as causing corruption first, and second which effects it may have.

Most causes for corrupt practices are based on economic incentives. As Jean-Claude Waquet (1984) points out as early as in the 18th century, there is a very strong link between the pay of public officials and the inclination to engage in corrupt acts[15]. He concluded that too low salaries will force them to take and demand bribes either out of fear of losing their job, of not getting a pension, in order to pay for their costs of living, or to raise their social status. The latter is a particularly interesting moral issue in society. The more tainted society is, and thus the environment in which a civil servant finds himself in, the higher will be his acceptance of his own moral wrongdoing as a way to carry on[16].

Another very evident source of corruption are trade restrictions. As mentioned earlier, bad regulation can force economic agents to engage in corrupt behaviour, as this might be the only way to break economic stagnation. Tim Harford mentions the example of Cameroon where trade restrictions make for such a high market entry hurdle for new businesses that barely ever anyone is able to start a new business (2005). As a result only those with connections manage to bribe their way into opening new businesses. Generally, those restrictions reach from price controls, to export and import tariffs, to any kind of administrative fees. Levine and Renelt (1992) mention multiple exchange rate systems as another way of compromising market efficiency and thus fostering corruption as a means of circumvention or infringement of the rule. Mauro (1997) adds that natural resource endowments are incentives to corrupt practice since their price is higher than their withdrawal. He also mentions sociological factors such as clientelism and favoritism as forms of corruption that concurrently incite corrupt behaviour.

Given the above causes, Rose-Ackermann (1997, pp.38-40) offers an interesting formula, which provides a very pragmatic understanding of factors, from which corruption emerges. According to this train of thought the surfacing of corrupt practices hinges on the price that one can attach to it. The latter is determined by factors such as the amount of obtainable public resources, the power position of an official to maintain control over those resources, the competitive negotiating position of corruptor and corruptee, and most importantly the security of successful bribery, that is the likelihood of public exposure and penalty. In other words the attractiveness of a corrupt arrangement depends on its price (which is determined by the above variables) and if that is too high, the arrangement does not come into existence. If it is low enough, its spreading nature leads to the following consequences of corruption.

The most discussed and most devastating consequence of corruption is its inhibiting effect on economic growth and development. As an example Afghanistan has consistently been one of the most corrupt countries in the world, as is shown by TI’s CPI (Transparency International, 2009). Equivalently, its development does not at all keep up even with that of most other developing countries (World Bank, 2010)[17]. As subsets of growth and development, Mauro (1997, pp.87-88) mentions that corruption leads to a reduction of investment incentives, a decline in tax returns, bad financial administration, ‘inferior public infrastructure and services’, and a worse ‘composition of government expenditure’. Glynn et al. (1997) mention decrease of public benefits and higher income disparity[18] as factors, antecedent to stunted growth and development. Moreover, corrupt practices, once established, alter the playing field in such way that agents that are unable to engage in those practices, face tougher conditions of market entry or participation. In the same way, ‘[c]orruption distorts competition and may reduce gains from free flows o trade and investment’ (Glynn et al., 1997, p.13).

Mauro conducts a regression analysis by means of data sets provided by Business International Indices of Corruption and comes to interesting conclusions. Whilst the credibility of the index is questionable as discussed earlier, he deduces that ‘a one-standard-deviation improvement in the corruption index causes investment to rise by 5 percent of GDP and the annual rate of growth of GDP per capita to rise by half a percentage point’ (1997, p.87). Similarly he derives from the data that ‘corrupt politicians choose to spend more on those components of public expenditure on which it may be easier or more lucrative to levy bribes’ (1997, p.93). Most notably, educational spending abates as soon as the corruption level rises in a country[19]. The data indicates comparable results for public health spending. Needless to say, both good investment levels and high educational spending are indispensable factors of economic development.

Finally, it is important to keep the international perspective in mind. Corruption is not only devastating to local economies but very much so to the reputation of foreign multinational corporations. Long and Rao find evidence that the reputation loss due to public awareness of involvement in corrupt practices has a substantial effect on the value of corporations (1995).

Both, the causes and the effects adduced here are based on politico-economic studies of corruption. It thus becomes apparent that most statements of corruption-related issues are dependent on insufficiently reliable data, which at the most allows for tentative conclusions. Chapter 3 will demonstrate the advantages of experimental evidence when it comes to understanding and evaluating the causes and consequences of corruption.

2.5 Conclusion

I have defined corruption on an economic basis and on a moral basis and given a political and social framework to it, which illustrates its complexity. I did this with two intentions.

Firstly, I wanted to present the background of different understandings of corruption in IPE, in order to later be able to make statements about the way in which our current understanding of corruption in the subject may be revised or added to. To make this possible, by way of introducing some sociological thoughts on corruption, it was worthwhile adding theory that as such is not part of a traditional understanding of corruption in IPE.

Secondly, by providing a definition that seeks to be as unambiguous as possible, I aimed to provide the reader with a solid basis for the third chapter, which intends to show what improvement economic experiments bring to our understanding of corruption. The various conceptions of corruption in the literature proved this to be greatly advantageous. Although this definition does not incorporate the insights I aim to add to the debate in the next chapter, it should nevertheless be consistent with them.

3 Understanding Corruption through Economic Experiments

This chapter has two aims. First, it will present the reader with a very brief outline of typical methodology of economics experiments. Second, it will put forward the upshots of corruption-related experiments.

The previous chapter has provided a rounded background analysis of economic, social (cultural, moral) and political dimensions of the corruption concept, it has come to an unambiguous definition of it, and finally it discussed the causes and consequences of corruption, all based on a conventional understanding of corruption in IPE.

A range of economic experiments have come to cover various areas and dimensions of corruption to improve our understanding of the matter and with important policy implications. There are experiments on the effects of externalities and reciprocity, on the cultural dimension of corruption, on its spreading or epidemic nature, and many on regulation and governance (risk of detection, public exposure, punishment, penalty etc.). Many experiments also reveal social facts, such as economics students that self-select their field of study according to their personality, some experiments produce findings about the price of bribery and the salary of public officials, and finally there are a few insights with regards to corruption’s consequence of increased (income) inequality among society. The implications of all those affairs will be the core of this chapter.

What is more, there are quite a few matters, which have not yet been covered or would be nonsensical to cover with economic experiments. While it would be useful to produce experimental evidence on trade restrictions, grease money, and stunted investment through corruption, it would be either too difficult or even futile to conduct experiments on matters such as reduced tax revenues, bad financial administration, bad public infrastructure and services, a decrease in educational and health spending, or the profit losses and penalties experienced by MNCs, all those being typical consequences of corruption.

The insights provided by experiments in the following sections will only vaguely be structured along the different aspects of corruption mentioned above, and more so provide brief summaries of the results delivered by each experimental corruption related paper. This makes sure that results remain in their context and it should be easier on the reader. Finally, some of the experiments covered here are also able to provide findings such as gender differences and other social factors that are not part of the conventional understanding of the matter. The chapter will end with some concluding remarks about the value added by experimental evidence.

3.1 Experimental Methodology

The main purpose of economic experiments is to test theory by creating an environment that is as natural as possible but allows for control of all its variables apart from the subjects, whose behaviour is to be analysed (cf. Krause et al, 2004; Camerer, 2003). Observations can then be made in a ceteris paribus kind of scenario, giving the experimenter the ability to single out certain subjects’ behaviours. An experiment is set up according to certain rules (its institution), and for its agents (buyers, sellers etc.), which are embodied by the subjects. The setup of the experiment has to match up with the theoretical assumptions, which allows experimenters to draw conclusions about the predictive accuracy or correctness of the tested theory.

3.2 Experimental Results

This section provides evidence gathered through experiments. It will first offer some general insights, and then explain in more detail one very rewarding bribery experiment, followed by the findings from most other experiments conducted so far.

When looking at the findings that experimental economics offer to the study of corruption it is helpful to first turn to the work of Krause et al (2004). In their review of experimental evidence the authors draw upon findings stating that people are more generous with regards to public resources, that is, they produce fewer externalities such as corruption, if there is more open communication between them. This proposes that TI’s strategic focus of transparency is very much justified. Further, the authors point out that higher homogeneity of economic actors leads to the same effect. Thus aiming for equal opportunities, fair wages etc. will concurrently decrease the inclination of people to engage in corrupt practices. While traditional research found that corruption leads to greater inequality of income distribution, experiments propose the opposite, this is to say more unequal income distribution leads to more corruption.

Krause et al (2004) also mention that it could be verified that incentives such as punishment, peer pressure, fines etc. are definitely useful measures against the abuse of public goods. It was further found that, against traditional theory, extrinsic motivation such as punishment, can lead to worse results than intrinsic motivation, such as fairness and reciprocity, to refrain form abusing public goods, which will become clear in the following review. Finally, the authors pointed out that the effect of good institutional design as lowering the abuse of public goods, in other words the significance of the amount and the kind of regulation, is consistently underestimated.

To look at the slightly more detailed setup of a corruption related experiment, the following is useful. Abbink et al. (2002) have developed a bribery experiment, based on 18 pairs of randomly assigned pairs of public official and firm, playing three games of 30 rounds[20] each. In the first one, firms could offer a user-defined bribe and increase their benefit if the official accepted. In the second game, the corrupt cooperation would not just lead to benefiting bribing pairs but also impose an externality (financial harm) on all other players, in order to see whether moral pressure reduces corrupt inclinations of players. The third game involved an additional sudden death mode, allowing experimenters to introduce a very low risk of penalty (p=0.003), which threatens players to be excluded from the game[21]. The experiment offers a range of insights. When comparing the first and the second game results it turns out that against the intuitive hypothesis (moral pressure to reduce corrupt inclinations) no ‘apparent influence of the negative externalities on decision behaviour’ could be observed. It was merely discovered that ‘the damage done to others seems to strengthen the sensitivity for kind and unkind behaviour between the two players in one pair’ (Abbink et al., 2002, pp.12-13). Further, it was detected that corruption levels went up throughout the first ten rounds in each game and remained steady after. This suggests on the one hand that there can be a limit to corrupt inclinations and on the other that corruptors slowly approach such maximum until it is found. The third treatment shows however that the threat of punishment does lower corrupt inclinations, although the probability was very low. It was also observed that the risk was underestimated over time, which seems to suggest that people acclimate to it. Counter-intuitively, public officials tended to reject bribes that were ‘too high’ even though technically risk did not increase with higher bribes[22]. The authors conclude that policy makers are ill-advised to urge public officials to show solidarity with their fellow-citizens when aiming to reduce corruption. Instead, incentives such as the penalty threat are much more effective.

Interestingly, Xiao’s (2010) findings of a punishment corruption experiment show that if the punisher’s (for instance from third party law enforcement agencies, bailiffs etc.) incentive to punish emerges from monetary benefit and not fairness considerations, this lowers the effectiveness of punishment and makes this law enforcement more corrupt. For policy considerations the author concludes that it is counterindicated ‘when punishment becomes a source of revenue for enforcers’ (Xiao, 2010, p.23).

In her most recent experiment Serra (2010) examined the effectiveness of top-down, bottom-up and combined means of punishment in a bribery game between public officials and citizens. She conducted three cases, examining corruptibility of public officials, first, when merely under surveillance, second, when they were subjected to a low risk of punishment (0.04) from the top (e.g. political elite), and finally, when the same four percent chance of detection and punishment was additionally dependent on a citizen’s report of the corrupt act. The surprising result was that the combined accountability (four percent chance of punishment from the top only if citizens reported) was significantly more effective in reducing the amount of bribes demanded by officials. It springs to mind that this is irrational as the probability of punishment is now lower, that is 0.04 times the inclination of the citizen to report (case 2) in contrast to just 0.04 (case 1). The involvement of another influencing factor in the composition of risk of punishment (that is the likelihood of a citizen to report) seems to lead to increased risk aversion, even if the newly composed risk is lower. Serra sees one possible reason in the additional ‘social’ loss through being reported (as opposed to simply being subjected to a risk of punishment). Another reason could be a repugnance to breach of trust as a result of being reported. Finally, Serra draws on findings of Tversky and Kahneman (1983), saying that it could be the case that officials aggregate risk incorrectly, in other words they conclude falsely that risk increases with additional reporting dependency.

Barr and Serra (2009) find interesting evidence that adds to the findings of Abbink’s experimental bribery game (Abbink et al., 2002). The latter concluded that, if corrupt behaviour caused externalities, this was not an incentive for people to reduce their corrupt inclinations. The authors found that closer reciprocity in their petty corruption game with no anonymity among players does reduce corrupt behaviour. Surprisingly however, negative framing, that is, adding a negative connotation to the practices of the game by terming such acts bribery, does have an influence, but not a significant one overall. Rather, framing seemed to amplify the contrast between corrupt and incorrupt practices. As a result, personal relations and the absence of competition will lead to less corruption than anonymity and competition. For policy makers this supports the idea that raising awareness of the immorality of petty corruption in countries, where this occurs, is useful.

Büchner et al (2006) also found that a negative framing (such that players are aware of the negative impact their corrupt acts have on others) in a bribery game does not portray a hurdle, as long as there is no fear of punishment.

Also Abbink and Henning-Schmidt (2006b) produced an experiment trying to answer the question of how relevant the influence of framing is in economic experiments. Largely coherent with the other studies, negative framing does not have a significant effect on corruptibility in bribery games.

The authors Lambsdorff and Frank (2010) conducted an experiment that compared levels of corruptibility between payments that were framed as bribes and those that were simply called gifts. They found that gifts are less effective means for businesses to achieve their aims than bribery, as firms were more persistent on a return of favour from officials if their payment was classified as a bribe. They further find that opportunism is a reason for corruption and that it bears an even greater risk in reality than in they game. Exceptionally, in this case the different framing of bribe and gift did make a difference, which is not only significant but also likely to hold in the real world. The authors conclude that policy makers should ‘improve incentives for ”good” whistleblowers’ (those public servants who report upfront of businesspeople who report after obtaining the contract) and deter the “bad” whistleblowers (who threaten to retaliate after being cheated)’ (Lambsdorff & Frank, 2010, p.354).

Campos-Ortiz (2010) carried out two rounds of experiments with the recent one conducted earlier this year. He finds that, first, the more disapproving citizens are of corrupt practices, the lower is also the risk of subverting the rule of law, which regulators run with harsher anticorruption measures. Second, and complementary, the more inclined to corruption bureaucrats are, the higher is the potential damage to citizens when regulators impose harsher anticorruption measures. The latter is the case because, according to the experimental outcome, corrupt bureaucrats are more prone to demand larger bribes from citizens to compensate for the higher expected penalty. Campos-Ortiz argues that therefore it is important for policy implementers to consider background and past of public officials in office, and weigh up potential dangers according to the above experimental outcomes before drawing conclusions about potential policy implementations.

Frank and Schulze (2000) examined the controversial question of whether economics makes citizens corrupt with an interesting conclusion. Although their experiment suggests that economics students are significantly more self-interested and corrupt than other students, it shows that this is not the case because of their exposure to economic theory (self-interest etc.). Rather it is self-selection. That is, students choose to study economics because they are on average more self-interested. This thought proposes that corruptibility and self-interest differ significantly among members of society. Policy makers should ideally focus on ridding incentives to engage in corruption for those that are most prone to do so.

Krastev says with regards to conventional understandings of corruption that ‘[t]he claim of the new anticorruption science [of recent decades] was that corruption has nothing to do with cultures, [but that] corruption is characteristic of institutional environments and characteristic of certain policies’ (Krastev, 2004, p.31). However, economic experiments have come to remarkable results when it comes to cultural differences in corruption related matters.

Cameron et al. (2009) have conducted a bribery game comparing data from experiments with students in Australia, India, Indonesia and Singapore. When contrasting the results with corruption levels measured with TI’s CPI, the authors could verify as predicted that ‘the subjects in India exhibit a higher tolerance of corruption than the subjects in Australia’ (Cameron et al., 2009, p.843). Corruption tolerance was however higher in Singapore and lower in Indonesia than anticipated according to TI’s data sets. The study insinuates that, first of all, there are significant differences of corruption tolerance and inclination between cultures[23] and secondly, that the CPI is not necessarily as accurate as it claims to be[24]. When interpreting those results it is very plausible to conclude that high levels of exposure to corruption promote the tolerance of corrupt practices as a ‘corrupt environment may justify one’s own corrupt behaviour’ (p.844). This is because corruption levels as well as acceptance of corrupt behaviour are ‘determined by the social, institutional (political and legal), and economic backgrounds of the [examined] countries’ (p.844). In other words, Singapore has very low actual corruption levels but yet an unpredicted high tolerance of corruption because the country has experienced much higher actual levels of corruption in the past—a finding that reveals shortcomings of conventional theory. Technically, institutional changes have lead to a drastic change of actual corruption levels while the process of social transformation, that is the tolerance of corruption, has been happening at a much slower pace. Accordingly, the experiment also showed that throughout different cultures there is greater fluctuation of toleration of corrupt practices, whereas inclinations to act corruptly are more consistent between cultures. This allows for two interpretations; first, that the institutional setup is largely responsible for actual corruption levels while social attitude towards it depends on cultural and previous institutional setups; second, that institutional change has not only a stronger but also a quicker, more direct influence on actual corruption levels than cultural changes. The study therefore reconfirms that corruption is, by and large, a problem of bad regulation and further that good regulation is the fastest route to less corruption.

Barr and Serra (2008) carried out very useful research, successfully predicting corrupt practices in the experiment by TI’s CPI. With this study it was possible not only to verify some of TI’s data sets. More importantly, the researchers were able to make a case for the hypothesis that generally culture shapes norms and thus frames people’s behaviour in such way that corrupt countries tend to ‘produce’ more corruption-prone citizens. In other words, corruption is at least to an extent a cultural thing.

Alatas et al (2009b) compare Indonesian subjects from students and public servants and find that the latter are significantly less inclined to corrupt behaviour. By distinguishing between students that want to work in public office and those that do not, and finding that there is no difference between their inclinations to corruption, it could be ascertained that the effects are not due to self-selection. The researchers infer that students reflect a more general cultural attitude (Indonesia has a past of high corruption) whereas officials might have changed their attitudes in a sense that they gained motivation to refrain from corrupt behaviour during the course of Indonesia’s democratisation (as a result public corruption has notably decreased in Indonesia). In other words, ‘experience shapes attitudes’ (Alatas et al., 2009b, p.130).

The same researchers also conducted an experiment on the relation of gender, culture and corruption with very important policy implications (Alatas et al., 2009a). By experimentally comparing corruption inclinations between genders and four different countries, namely Singapore, India, Indonesia and Australia, only the latter proved women to be less corrupt. The suggestion is that gender differences in corruption are primarily conditional upon culture. This insight is fundamental when considering that many developing countries have increasingly employed female bureaucrats as an anticorruption measure. The reasons behind those results could potentially lie in a tendency, which states that more patriarchal countries have an effect of strong assimilation of women to men, whereas in individualist Western societies women’s attitudes do not depend as much on male value systems.

A similar study by Rivas found that ‘women may be more relationship oriented [and] may have higher standards of ethical behaviour’ and subsequently concluding that men were more corrupt (2008, p.1). Considering Alatas’ et al (Alatas et al., 2009a) upshot on cultural differences, it would stand to reason to interpret Rivas’ findings in just the same way; women are less corrupt in Western cultures[25], maybe because they are more individualistic.

Another experiment revealed three interesting micro-determinants of corruption. Whilst confirming that ‘women may be more responsive to monitoring and punishment’ the researchers found ‘that the probability to accept a bribe decreases with the grader’s age, religious fervour and ability at the grading task (Armantier & Boly, 2008, p.21).

In addition to the above experiments, some others make suggestions about the epidemic nature of corruption. Gino et al. (2010) gathered experimental evidence suggesting that people who believe to be wearing counterfeit sunglasses, firstly, are much more likely to engage in other unethical behaviour, and secondly, tend to assume other people’s behaviour to be more unethical, both due to their seemingly compromised feeling of ethical legitimacy. Further, the authors found that self-alienation through wearing counterfeit products ‘was a significant predictor of dishonesty’ of the subjects (2010, p.719). Although this study is based on counterfeit as the reason for subjects’ unethical self-perception, it allows for the tentative conclusion that possibly any unethical self-perception leads to both more unethical behaviour and the judgement of others as more unethical. In a context of corruption this could mean that in a society where circumstances have once led to corrupt practices, at least those engaged in them are now more inclined to act corruptly again and possibly with less scruple[26].

Bilotkach (2006) found through a tax evasion-bribery game that corruption can spread as bureaucrats become known for corruptibility. That is to say, the more bribe-accepting officials there are, the more likely are businessmen to offer bribes. This implies also that perception, as opposed to actual levels of corruption, could lead to more bribery.

Schulze and Frank (2003) conducted experiments with two setups; one under surveillance and one without. It was found that although the deterrent effect of public observation is significant, particularly at large-scale corruption, it lowers or eliminates motivation through fairness considerations. Furthermore, although reasonable officials’ pay can lower corruption there is no sufficient compensation to completely discourage corrupt bribe taking. Moreover, the researchers found that women are more risk averse and therefore less corrupt when monitored, but they are not less corrupt per se. On the contrary, economics students appear more corrupt (self-interested) only when their behaviour is not publicly exposed. Conclusively, policy makers should consider either very pervasive surveillance (so that the deterrent effect can override with certainty) or not at all (as otherwise the reduction of intrinsic motivation increases corruptibility).

Abbink (2005) also conducted an experiment on the relation between bribery and the pay of public officials. He could show that if higher pay of bureaucrats was to have a reducing effect on corruption then this is not because of intrinsic moral motivations.

Finally, Carrillo conducted a principal-agent-client based bribery experiment, by which he found that ‘traditional analyses have systematically overestimated the beneficial effect of increasing wages as an anticorruption measure’ (2000, p.257). During the experiment, a pay rise for officials was near compensated for on the part of the clients by paying higher bribes. It follows that instead anticorruption measures should lay greater focus on keeping the bribe price as high as possible so that corrupt clients have no incentive to maintain their cooperation with agents by increasing the size of the bribe.

At last, the following ‘unorthodox’ but promising approach is the research conducted by Zak and Fakhar (2006). The Neuroscientists examined the amount of oestrogen-akin substances in our nutrition in an international comparison, which is causally related to different levels of trust according to geographical location of foods. As trust and corruption are strongly linked, there is a potential between connection between corruption tolerance and inclination and diet.

3.3 Concluding Remarks

The above experimental review has chronologically covered experiments on externalities, trust and reciprocity, on regulation and governance, on culture and gender, on the spreading nature of corruption, as well as on public pay and income inequalities. Having considered all this, it becomes apparent that the traditional understanding of corruption in IPE based on standard economic theory and political relations can be superficial and sketchy, when it comes to underlying psychological and cultural causalities.

It can be concluded that, although regulation in conjunction with corruption is a critical concern in the conventional theory of IPE, its importance when it comes to eliminating corruption incentives has systemically been underestimated and needs to be stressed. Furthermore, while conventional theory recognises that fairness considerations, reciprocity, trust etc. play an important role in understanding corruption, it is mostly unable to distinguish between intrinsic and extrinsic motivation. In contrast experiments are able to make relatively unambiguous statements about regulative factors such as the probability of detection and punishment or sociological factors such as social punishment or loss of reputation, which are for instance experienced after being reported. Moreover, IPE has a strong focus on the international aspect of corrupt relations and practices. It is, however, unable to come to correct conclusions if it fails to recognise the statements, which experiments are able to make when it comes to differences of culture and gender. This is the case in particular in conjunction with political theory, when it is possible to identify dependencies between current toleration and inclinations to engage in corruption in certain countries on the one hand and the political history of those countries on the other. Finally, as Krastev (2004) claims, today’s anticorruption consensus may have a strong foundation on neoliberal thought. Economic experiments, in contrast, can be setup independently of any ideological direction.

Conventional theory of IPE helps elucidate the larger coherences of corrupt practices between countries, multinational corporations, international institutions etc. What this analysis has shown, however, is that it neglects important details, which makes it not only very useful to take into account experimental outcomes (in the case of additional understanding and verification) but also necessary to incorporate them, as it enables scholars to the falsification and correction of conventional theory. As a result, an interdisciplinary understanding of corruption makes for a less fallible assessment of corruption.

4 Measuring Corruption

In the first section of this chapter, I will briefly outline conventional measurement methodology and its challenges. In the second section, I shall illustrate the advantages of measuring corruption with the facility of economic experiments.

4.1 Conventional Measurement of Corruption

Having considered how difficult it is to unambiguously define corruption in chapter 2, the struggle one faces with measuring it is a logical consequence. But it is not only the fact that without a very clear definition it is impossible to deliver exact and comparable data. As mentioned earlier, most of today’s conventional methods do not necessarily specify what exactly they mean by corruption but take it as a given that there be some sort of a unanimous definitive agreement. The difficult practical problem lies in the covert nature of corrupt practices. It is for the same reason that only a fraction of cases raise public awareness, an even smaller number are prosecuted, and fewer still lead to conviction (Krastev, 2004). As Krastev points out, we could not measure corruption itself but merely our exposure to it. This thought finds support in the fact that there is great confusion about many cases, which bear the question whether corruption levels have risen, or simply the publicity corruption gets in the media has gone up (Krastev, 2004, p.46). After all, if one ignores the fact that there are economic experiments, it seems as though there were no ‘objective social science about corruption’ as Krastev alleges. He claims further, that it ‘was one science where every victim [thought of themselves as an] expert’ (Krastev, 2004, p.4).

Despite all confusion two general methods have emerged from the puzzling question of corruption measurement; one is based on numbers (for instance the amount of corruption cases per country during a particular time period); the other is based on perception, that is how citizens, business people etc. that deal with public officials perceive the level of corruption in a country. Both methods are not necessarily very reliable and even more difficult to compare internationally. Several institutions have published corruption indices[27]. The most sophisticated index is TI’s Corruption Perception Index, which finds itself improved almost on a yearly basis (Transparency International, 2009). In order to determine corruption levels it is built around several surveys per country and addressed to firms that deal with the public sector of a country or region[28]. In spite of a so-called ‘confidence range’, indicating the likelihood of accuracy per value per country, the index does not provide any information on an agent’s inclination to engage in corruption or his toleration towards corrupt practices. Moreover, differences in culture, political system etc. make it impossible to compare levels of corruption on a unique scale. Also, Mauro has two valid points: Firstly, every interview-based method of measurement is subjective and thus not without further ado generalisable. Secondly, most indices such as TI’s CPI do not distinguish between ‘high-level’ and ‘low-level’ corruption and neither between ‘well-organised and poorly organised’ corruption. (Mauro, 1997, p.84).

Krastev concludes that it is difficult to argue for either a purely numbers-based index or a perception-based account. In order to understand what he calls ‘the public mind’ it might make sense to analyse and understand the psychology of corruption and conclude from there. One would need a method that incorporates the exactness of numbers as well as the less precise social aspect of corruption gathered in perceptive interviews. The following section is dedicated to corruption measurement utilising experimental economics. This will bring hope to the debate, as both numbers and psychology are part of it.

4.2 Measuring Corruption through Economic Experiments

First of all, economic experiments have the clear advantage that their setup can be adjusted according to a distinctive definition of corruption, which, as established in chapter 2, is an important condition to be met.

As established above even the most advanced and complex indices such as TI’s CPI are not more accurate than the accumulation of subjective perspectives (inter-subjectivity). The setup of experiments allows circumventing the trouble of retrieving covert information about unethical behaviour by measuring it in an artificial but reality emulating environment. We can observe corruption by the experimenter-defined variables of environment and institution[29].

Another main advantages of economic experiments is that it offers the possibility to analyse both, how different types of regulation work in a set environment, and how a certain type of regulation works in different environments. Further, experiments allow drawing conclusions on the usefulness of types of regulation (the so-called ‘institution’ in an experiment) even if theory is insufficient to provide for a complex environment (Krause et al., 2004).

With the aim to produce generalisable results there are two main concerns with economic experiments (Krause et al., 2004). On the one hand, their set-up runs risk to resemble the real world in a too simple manner. On the other, the subjects may not necessarily be representative. The first, also known as external validity, is problematic only if the aim is to retrieve findings about a certain environment. As mentioned above, the usefulness of rules can mostly be measured regardless. The second, also known as population validity, is a more complex issue. As shown in chapter 3 experiments are able to reveal different degrees of corruption not only dependent on environment and institution but varying between cultures, field of study, profession, genders, age, religious fervour and ability, and perhaps even other determinants in future. The problematic trade-off arises thus between a random selection of subjects and a researcher-led selection of subjects. Neither is ideal as both run the risk of statistical distortion. Contrarily, Armantier and Boly (2009) were able to show that field experiments and laboratory experiments can be statistically indistinguishable, which is speaks for the possibility of external validity

Another potentially distorting influence with regards to results is the framing of experiments, mentioned earlier in chapter 3. However, Abbink and Henning-Schmidt (2006b) as well as others (cf. chapter 3) all found that negative framing has no significant influence on the outcome of bribery and corruption related experiments. They conclude that ‘neutrally framed experiments are not necessarily less interpretable in terms of a real-life situation than those presented in a [value-laden] context’ and further that a value-laden environment ‘does not necessarily distort experimental results or distract subjects from the strategic situation’ (Abbink & Hennig-Schmidt, 2006b, p.115). This remains however an issue. While the above researchers’ claimed insignificance of framing referred to neutral versus negative framing, Lambsdorff and Frank found that positive framing in their case does lead to significant differences (2010).

On the bright side, there are several issues with conventional measurement methodology that economic experiments do not face. Krastev points out in what way perception, as a means of measuring corruption is dangerous. A graphic example is Germany’s Kohl affair. Corruption in Germany did not change with the media’s awareness of the case, but the perception of Germany praised as one of the least corrupt countries did (Krastev, 2004). Further, social norms make for a bias in any sense. When for instance businesspeople working for Western MNCs are interviewed about their perception of levels of corruption in countries with different social norms than their own, then it does not matter how scientifically well-thought out the interviews are. Another example, as Krastev alleges, are the Nordic countries, which are known for both, very low corruption, and high government interference in the market economy. For Krastev those ‘[s]ocial norms are the independent variable in corruption equation that constrains the ambitions of institutional reductionism’ (2004, p.53). Economic experiments are however not only able to be independent of such variables, they can even measure those social factors as pointed out in chapter 3. In much the same way Krastev adds that when the ‘anticorruption discourse of IMF and Worldbank [holds] the claim that one political regime is more corrupt than another, [it] is not an empirical claim [but] a normative claim’ (2004, p.50). Experiments differ in that way.

In the end, both, conventional methodologies, and measurement through economic experiments, have their drawbacks. Considering the immense benefits of experimental measurement, such as the absence of the hidden-nature problem, it might be worthwhile considering the construction of a hybrid of today’s CPI and a simple principal-agent-client bribery game, measuring corruption per country. That way the two approaches would cancel out each other’s weaknesses and certainly lead to a less fragile corruption index.

5 Conclusion

This paper makes two claims. One is that the conventional understanding of corruption in the field of IPE is limited and that it should therefore be complemented by the diversity of conclusions that can be drawn from corruption related economic experiments. The other is, along the same lines, that the way corruption is measured with conventional methods, such as surveys on perception, is unsound and should be amended by the addition of measurement through experiments with the benefit of overcoming many common weaknesses.

In order to get to the first conclusion the paper provides the economic, social, cultural and political background that is necessary a) to elucidate what in this paper is referred to as a conventional understanding of corruption in IPE and b) to arrive at a (tentatively) less ambiguous definition of corruption as a concept than can be found in most of the corruption-related literature. With the addition of a brief discussion of the causes and consequences of corruption the information to this point provide a rounded picture of the different dimensions and aspects of corruption in the IPE.

As the counterpart to the latter, the paper presents most of the conclusions and policy implications that can be drawn from corruption related experiments to-date. While traditionally IPE is able to give a thorough understanding of what triggers corruption, what increases or reduces corrupt practices in an economy, or what its consequences are, it is less able to explain underlying psychological, sociological and cultural processes and particularities. The astonishing results of economic experiments do not merely supplement our understanding of corruption by illuminating those underlying facts—they can actually falsify conventional theory. To restate an example, experiments can prove that increasing levels of officials’ pay reduce corruption but that there is no satisfactory amount of pay. Another example is the false conclusion that women were generally less corrupt. It has led to unjustified policies that promoted women in public positions in many developing countries.

The analysis comes to several conclusions about areas in which the traditional understanding should be improved. Experiments that examined reciprocity, trust and fairness considerations are able to make significant statements about intrinsic and extrinsic motivation of corrupt actors, for which traditional theory does not have a cardinal measure of distinction. A typical example is that monetary incentives for punishing corruptors eliminates the latter’s recognition of his own moral wrongdoing and thus reduces the effectiveness of such anticorruption measures. Various experiments dealing with regulation, detection and punishment of corrupt practices show that a) the role that regulation plays in diminishing corruption incentives is systemically underestimated, b) that the direction (from top or through reporting by principal) and the kind (moral loss/fear of risk, social/monetary) of punishment play an important role in reducing corruption, c) that higher homogeneity and more communication in a populace reduces corruption, and d) that different people (gender, culture, self-selection) react differently to threats such as probability of detection or penalty. Standard approaches will not reach such conclusions, last but not least because of the covert nature of corrupt practices. Moreover, while the discipline of IPE recognises the role of cultural aspects in the world economy it is unable to disclose (by way of its restricted means) the ties between political background, gender-relations, culture and institutional setup, as shown by Cameron et al (2009) intercultural experiment. While conventional theory struggles with dilemmas such as the universalism versus relativism debate, experiments are able to measure cultural differences in dispositions to corrupt behaviour, based on a relatively neutral (economic) definition of corruption. Also, some experiments are able to shed light on the actual process of corruption’s epidemic and demoralising nature, which traditional theory could not explain but merely observe as present. Furthermore, while conventional theory is unable to draw a clear line between notions such as gift, favour and bribe, it is possible to isolate the differences of those nuances through economic experiments. Other experiments are able to disclose irrational behaviour in cases that entail a prisoners’ dilemma. Finally, economic experiments could deliver new insights into the relations of income inequality and corruption, explain the limitation of officials’ pay rises as a means of lowering corruption, and can be conducted independently of ideological content. All these results show that an interdisciplinary assessment of corruption (a merger of conventional theory and experimental insights) is less fallible.

With regards to the second claim, the paper gives account of traditional methodology and its drawbacks and presents solutions that experiments offer to overcome such issues. Since corruption is conventionally measured either by extrapolation of known corruption cases or by a perception based assessment of corrupt practices through survey based aggregated indices, it suffers from its naturally clandestine state. Moreover, also based on the problem of aggregated subjective perceptions any such conventional method suffers from an ambiguity in the corruption concept, as definitions differ from person to person. As clarified already in the first chapter this is not desirable. Since TI’s CPI is the today’s most credible corruption index it has been chosen as an example in this paper, advocating it as the best method of conventional corruption measurement.

The use of economic experiments has its own weaknesses, such as external validity and population validity and the larger debate around the framing of experiments. More importantly, however, it does not suffer from the same weaknesses as traditional methods of measurement. The structure of experiments allows for a thorough analysis of the data (no covertness), for a strict control of institution and environment, and for the possibility of validation of outcomes and data through equivalent field experiments. Considering the benefits of both methods, I suggested the addition of a simple bribery game to TI’s CPI as a means of verifying and, where necessary, correcting its predicted data, as well as adding to the richness of the data and the conclusions that can be drawn. Such hybrid form is neither significantly more laborious nor expensive.

5.1 Future Research Avenues

With regards to the analysis of chapters 2 and 3, it would be useful to conduct experiments in areas such as trade restrictions, grease money[30] and stunted investment through corruption.

Moreover, as pointed out by other authors in the field, we have yet much to learn about framing and its implications for the real world. In this context, it would be worthwhile to conduct an experiment that examines whether the tolerance for unethical behaviour, after exposure to others’ unethical behaviour in news and media, increases.

Particularly interesting are the results of the counterfeit-sunglasses experiment mentioned in chapter 3 (Gino et al., 2010). It may be useful to capture this phenomenon in a similarly constructed corruption-based experiment.

Moreover, in order to make a statement about power relations it would be sensible to set up an experiment to determine whether a position of power will increase tolerance and propensity to engage in corruption. This could confirm findings of experiments conducted to-date, which allow for the argumentum e contrario that more power implies less risk and thus a higher inclination to engage in corrupt acts.

Finally, it would be very useful to examine corruption further by variations of Duflo’s of randomisation experiments conducted in conjunction with MITs J-PAL lab (Massachusetts Institute of Technology, 2010).

6 Bibliography

Abbink, K., 2005. Fair Salaries and the Moral Costs of Corruption. In Kokinov, B. Advances in Cognitive Economics. Sofia: NBU Press.

Abbink, K., 2006a. Laboratory Experiments on Corruption. In S. Rose-Ackerman, ed. International Handbook on the Economics of Corruption. Cheltenham: Edward Elgar Publishing. pp.418-37.