In 2015, the Cooperative Republic of Guyana became a subject of interest among the oil industry operators. After decades of the granting of an exploration license in the Stabroek block, Exxon Mobil notified the discovery of prolific oil reservoirs. The discovery of hydrocarbons in the Liza I field, qualified as the biggest discovery that year in the world, put the country on the map of this industry and attracted the attention of other operators interested in business opportunities in new oil provinces. Since then, the growth in the number of discoveries has opened up the possibility of Guyana becoming a major oil producer and using that wealth as a basis to boost the economic development of one of the poorest countries in the Americas. However, along with this opportunity, the Guyanese government also needs to face the challenge of making proper use of these resources that are just beginning to flow in order to avoid adverse effects. The challenge is linked to phenomena such as the resource curse or the paradox of plenty, which have proven to be real obstacles to economic development in countries with resource-intensive economies, particularly oil. For this reason, this work analyzes the opportunities and challenges of the boom of the oil industry for the Guianese economic development.

Theoretical Considerations on Natural Resource-intensive Industries as Levers for Economic Development

Since the 1990s, several studies have attempted to show the existence of an inverse relationship between economic growth and resource-rich countries, based on theses such as the resource curse and the paradox of plenty (Auty, 1993; Sach and Warner, 1995; Karl, 1997). Both suggest that economic specialization in natural resources, and especially oil, can generate negative effects on a country’s economic and political institutions, impacting its ability to respond adequately to the price volatility that characterizes these industries, and therefore the impossibility of achieving sustainable economic growth rates.

In economic terms, during cycles of rising raw material prices, the exports of these goods produce an exchange rate appreciation that affects the competitiveness of local industry. This phenomenon, commonly known as the Dutch disease, produces a dynamic that discourages the development of the secondary sector of the economy. Besides, the specialization in natural resources would have a reduced potential in the construction of productive chains for other sectors of the economy, due to its characteristic of “enclave industries” (Hilson and Laing, 2018). Besides, it would also discourage entrepreneurship and reduce learning processes among economic agents (Black, 2017).

The volatility of commodity prices can also create conditions of uncertainty in producing countries. Cycles of price increases can generate both pressure and incentives for governments to adopt expansive fiscal policies, leading to accelerated and unsustainable rates of economic growth, followed by periods of economic recession and the need to adopt contractionary policies (Morey, 2018). In many cases, the revenues from these industries discourage the search for tax-based financing of state activities (Karl, 1999). Also, governments face difficulties and resistance to correct the repetition of this pattern, because demand during cycles of price expansion is for increased spending, and during cycles of decline, the political costs of adopting corrective policies are very high, encouraging the extension of adjustments (Karl, 1999).

Political and social factors, prior to or during the expansion of productive activities in resource-intensive industries, may influence the processes of economic development in countries specialized in these activities (Rosser, 2006). Some studies have also pointed out that countries that have succeeded in driving successful economic development processes have had acceptable levels of institutional development (Rosser, 2006; Morey, 2018; Shookoonsingh, 2019). This characteristic can be explained in two categories of capacity.

The first has to do with building institutional capacity to manage the revenues earned from extractive activities aiming at its rational allocation in the improvement of the State’s capacities to execute public policies. In this regard, capacity-building should seek the consolidation of competent institutions in the management of the country’s macroeconomic and fiscal policy, seeking to mitigate the negative effects of commodities price volatility on the national economy (World Bank, 2019a). At the same time, this capacity building effort should aim at improving the provision of basic public services to overcome the gaps that prevent society from taking advantage of natural resources – education, health, infrastructure, science, and technology, among others. And, more fundamentally, they should consider the creation of incentives in the national and international private sector for the expansion of productive activity and the diversification of the economy (Tordo et al. 2013; Perez et al. 2013). Thus, activities related to natural resources can encourage the generation of more wealth and the possibility that citizens can benefit through access to new and better jobs.

The second category is related to the capacity of political and economic elites to establish governance structures in the country’s institutional design to define and sustain public policy orientations in resource-intensive sectors in the long term (Morey, 2018). In this regard, the absence of these two categories of capacities has been recurrently associated with the impossibility of shielding institutions and public policies from the occurrence of fiscally irresponsible decisions, unreachable goals, corrupt practices, among other phenomena, in countries that have not succeeded in managing their natural resources – Venezuela, Angola, Mozambique, etc. (Ascher, 2000; Auty, 1993; Rosser, 2006; Karl, 1999; Hilson and Laing, 2018). Furthermore, these gaps have been related to social tensions, the degradation of democratic institutions, and, in extreme cases, the occurrence of armed conflicts with devastating results on socioeconomic indicators (Rosser, 2006).

The Scope of Guyana’s Plans for the Oil Sector and Their Impact on the Economy

In 2015, ExxonMobil and Hess Corp announced the discovery of oil resources in the Liza I field, an area that forms part of the Stabroek block on the coast of Guyana. Since then, positive perspectives have led to increased investments in exploration and development in the country and the entry of other operators attracted by the Guyanese potential, accounting for more than US$ 8 billion at the end of 2019 (Rystad Energy, 2020). As a result, subsequent discoveries have increased the volume of proven reserves to eight billion barrels of oil equivalent, recognized as particularly good quality resources and competitive production costs when compared to other offshore basins (Exxon Mobil, 2020).

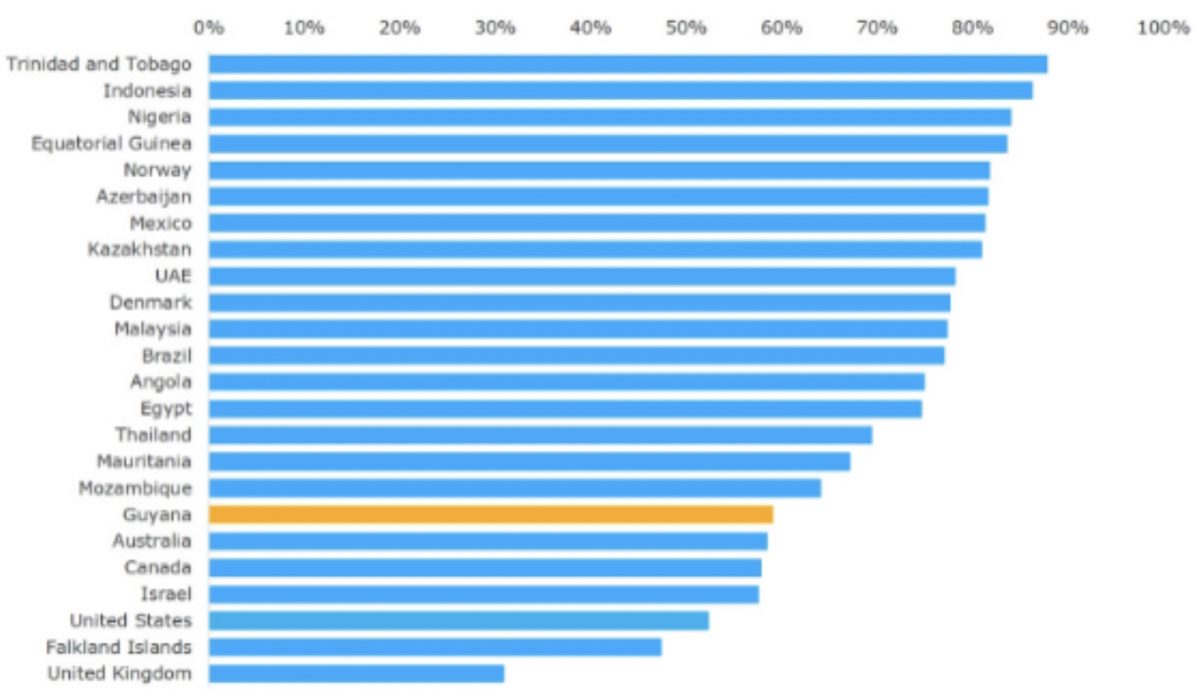

Also, the contractual terms established for the Liza I field project resulted particularly good for the consortium involved in the operation – Exxon Mobil (45%), Hess Corp (30%), and CNOOC-Nexen (25%). The regulatory framework for oil exploration and production activities in Guyana establishes production sharing as the contractual modality. Under the current tax regime, the government has established a 2% royalty rate and negotiated an oil profit rate of 50%. According to estimates by Rystad Energy (2018), the average government take under the terms established for the first phase of the Liza I field was 60%, leaving 40% for companies associated with the Guyanese state (see chart 1). Under these conditions, Guyana emerges as an attractive oil province for operators.

Chart 1. Average of government take from offshore E&P sector for selected countries. Source: Rystad Energy, 2018.

The Liza I field started production activities in December 2019. Exxon Mobil projections estimate to end 2020 with a production of 120,000 b/d. However, some projections indicate that Guyana’s oil production could increase to 750,000 b/d by 2025 and 1.2 mb/d by 2030 (Crowley, 2019; Rystad Energy, 2020). This increase in oil production would have potential impacts on oil geopolitics due to the geostrategic position of this country. By the end of the decade, Guyana would become one of the largest producers in Latin America, overcoming and compensating for the fall in the production of traditional players such as Venezuela, Mexico, and Ecuador. The expansion of oil production has the potential to open business opportunities with neighboring producing countries such as Trinidad and Tobago and Venezuela, especially the latter, due to the need to use light oils such as those already being produced in Liza I to process the heavy oils of the Orinoco belt, in a scenario of recovery of the Venezuelan oil industry.

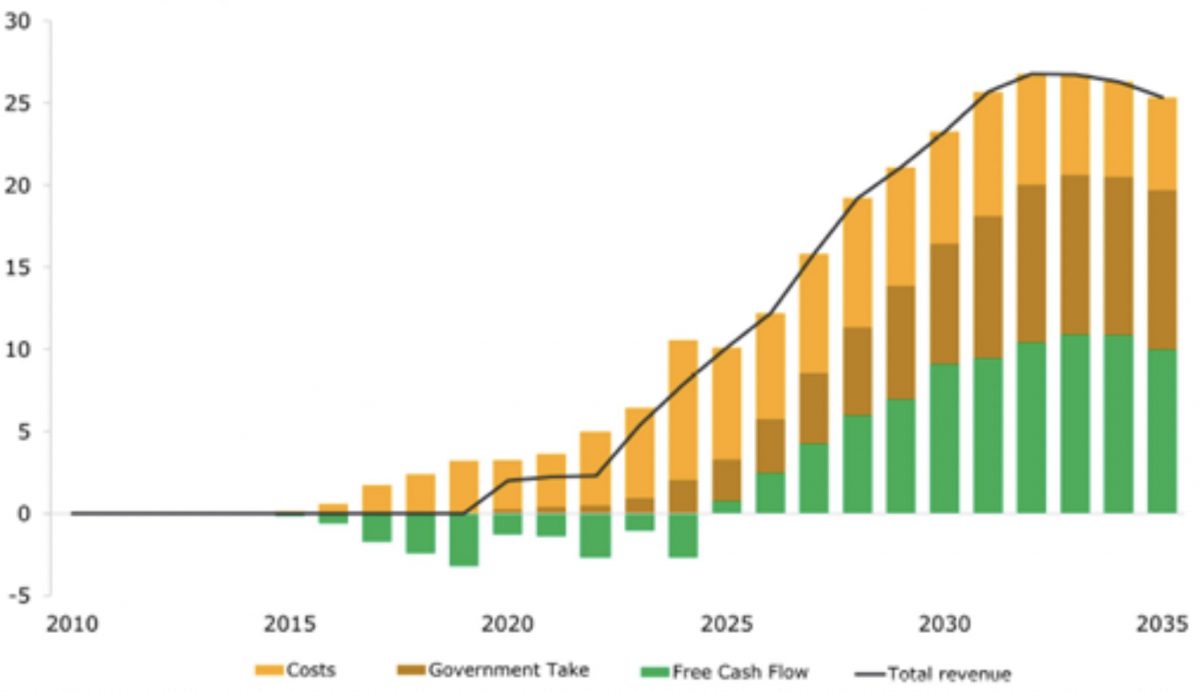

As a result of the increase in oil production, it is estimated that government revenues could start in the range of $270 million in 2020 and reach $10 billion annually by the end of the decade (Rystad, Energy, 2020) (see chart 2). The impact of these revenues on Guyana will be tremendous, since it is a country with a population with less than 800,000 people, with a small economy of $4.3 billion (World Bank, 2020). In these conditions, the IMF has estimated that the activities of the oil industry could boost GDP growth by 53 percent during 2020, even in the current international context marked by the coronavirus pandemic (IMF, 2020).

Chart 2. Guyana: projections on cash flow developments from oil production operations (constant USD billion). Source: Rystad Energy, 2020.

Shortly after the Stabroek Block discoveries, Prime Minister David Granger’s government began to work on plans to use oil revenues as a platform to boost national economic development, with technical advice from multilateral organizations and other countries. Beginning in 2016, the Guyanese government began the process of formulating the first plans to manage the oil policy and the wealth deriving from this activity. These efforts were aimed at strengthening the capacity of public institutions to execute policies in the O&G sector, to develop governance capacity, and to add value to the industry’s activities.

In 2018, after beginning to receive technical assistance from the World Bank, the bank granted a $35 million Development Policy Credit. The purpose of the financing is to support the Guyanese efforts to strengthen financial sector development and fiscal management capacities, as a way to prepare the country to benefit from the oil reserves discovered and turn them into human capital (OilNow, 2018). That same year, the Finance Minister announced the plan to administer revenues from oil production through the creation of a sovereign fund. As part of this decision, the Guyanese government also adopted 21 of the 24 Santiago principles, an initiative to promote transparency, good governance, accountability, and prudence in the use of resources managed by sovereign wealth funds (Guyana, 2018).

In 2019, also in cooperation with the World Bank, the Guyana Petroleum Resources Governance and Management Project was launched. The objective of the project is to support Guyana in the process of improving its regulatory and institutional framework, as well as strengthening the capacity of key institutions to manage the O&G sector in the country (World Bank, 2019b).

Since 2017, the government has also begun formulating a policy of local content for the oil sector, with the orientation of maximizing the participation of local labor and companies, including foreign companies with production parks in the country, in industry operations and the supply of equipment and services (Guyana, 2020). As part of a broader effort to diversify the economy, starting in 2017, the Guyanese government began working on the Green State Development Strategy, an ambitious plan formulated with support from the United Nations Environment Programme (UNEP) to boost the country’s development by introducing sustainability criteria until 2040. The plan seeks to create the conditions for the country’s population to make proper use of natural resources and generate wealth from them, through the achievement of three main aims: i) manage the country’s natural wealth; ii) build a resilient economy; and iii) build human capital and institutional capacity (Foreign Affairs, 2018).

Based on this set of plans, the government action aims to encourage the country’s economic diversification by adding value to the oil industry. At the same time, the government’s plans seek to expand productive capacity, modernize, and improve competitiveness in traditional sectors, such as ore (gold, bauxite, diamonds, among others), agribusiness, and fishing. The plans also aim to encourage the creation of new activities linked to the expansion of physical, energy, and telecommunications infrastructure in the country, tourism, and sustainable use of biodiversity (DOE, 2019).

Is Guyana Ready?

The scope of the plans to boost the country’s economic development, while extremely ambitious, point in the right direction. However, achieving these goals and avoiding the negative effects of poor management of these resources on the economy implies considerable levels of institutional strength. In this sense, major challenges still need to be overcome.

The first challenge in the Guianese case is to build an adequate institutional model and the necessary institutional capacity to manage the oil policy simultaneously with the process of expanding the productive activities of the oil industry and the execution of other development plans. The regulatory and institutional framework of the oil industry is outdated and incomplete, with almost all the regulatory provisions issued in the last century. In this sense, the country needs to advance expeditiously in updating the regulation of this industry to improve transparency and governance in the management of public policies, aiming at reducing the technical, environmental, social, and financial risks intrinsic to these activities (World Bank, 2019a).

The country has large gaps in technical and administrative capacity to manage and regulate the activities of the oil industry. This includes the shortage of specialist officials in public institutions with the task of managing public policies related to the O&G sector. In 2018, the Department of Energy (DOE) was created and is responsible for implementing public policies and supervising the O&G sector in the country. However, the DOE operates with reduced economic and human resources, and of the eleven employees who work in this office, only five are specialized in oil and gas (Crowley, 2019; Panelli, 2019; World Bank, 2019a). The Geology and Mines Commission (GGMC), which is responsible for regulating the O&G industry, has only eight servers trained in the sector, with a reduced budget and an accumulation of requirements for processing and interpreting oil data. The Environmental Protection Agency (EPA) has an outdated environmental licensing process and has gaps in human, financial, infrastructure, and equipment resources to fulfill its mandate (World Bank, 2019a). In this regard, Guyana needs to accelerate the process of building technical and administrative capacity to ensure that public sector agencies can implement public policies and deliver public services appropriately. Considering that the process of building these capacities can be a medium and long-term effort, the government should consider the need to hire experts from other countries.

Related to the institutional model of the country and the sector, another challenge that needs to be addressed by Guyana is the governance conditions for ensuring the long-term sustainability of development plans. While the formulation of government plans was the result of consultation with political, economic, and the community in general, there is evidence of discrepancies in oil policy decision-making. An example of this was the agreement for the development of the production of the Liza I field, in which government participation and signature bonuses were subject to criticism from political opposition and sectors of society for considering it very low and disadvantageous for the country (Crowley, 2019).

Furthermore, the political crisis unleashed by the Granger government’s refusal to recognize the outcome of the recent presidential elections introduces additional elements of uncertainty about the governance capacity to manage development plans in the country. Even reaching minimal agreements on the direction of economic development policies, the tensions between the political groups that control the country, mainly Indo-Guyanese and African-Guyanese, now interested in controlling the government to ride the wave of bonanza brought by oil production, may undermine the conditions of governance necessary to allow the proper use of these resources and drive investors away.

The establishment of minimum agreements on guidelines for the administration of resources is also fundamental to managing the expectations of the population. Likewise, the government must ensure fair conditions so that the population can benefit from this wealth. Otherwise, the lack of tangible benefits can give way to frustration and a crisis of expectations with a negative impact on the sustainability of policies, their ability to achieve the desired results, corruption, and even violence (Berg, 2020; Bryan, 2020).

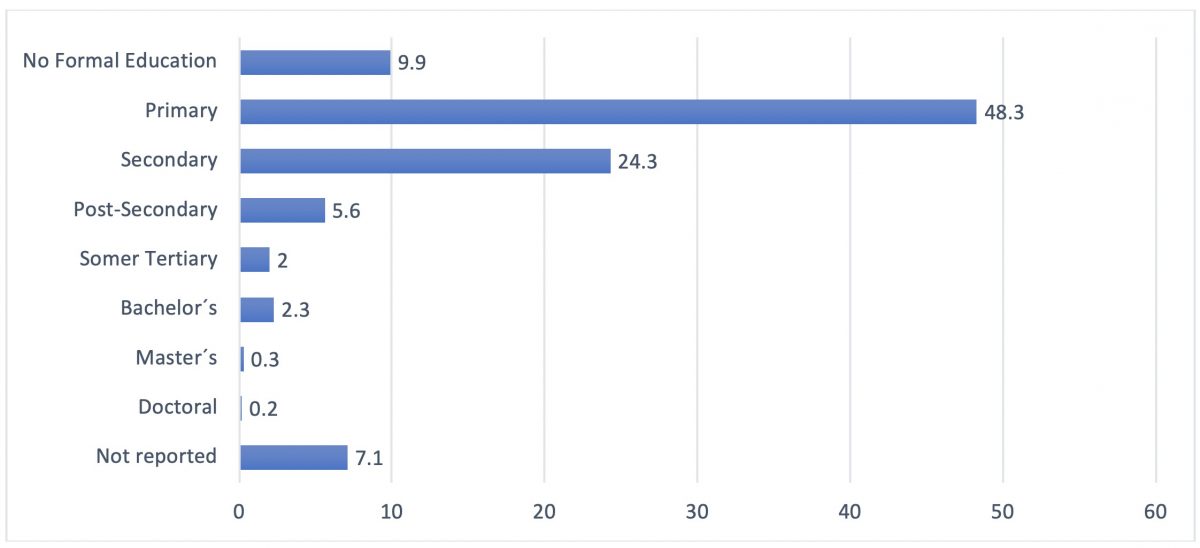

Guyana does not have such high levels of corruption. On the positive side, the Guyanese judiciary is recognized as having a strong institutional foundation (Panelli, 2019). According to Transparency International’s 2019 corruption perception index, the country scored 40 out of 100, ranking 85 out of 198 nations analyzed and 15th in the Latin American and Caribbean region. In this position, the country is still far from being among the nations that are examples in the fight against corruption. In this sense, the strengthening of institutions is fundamental to ensure adequate control organs and avoid the increase of corruption as the flow of petrodollars begins to enter the economy (Bryan, 2020). On the other hand, Guyana lacks sufficient human resources for the oil sector and other areas considered strategic for national development. In 2017, the Guyana Statistics Bureau, with support from the Inter-American Development Bank (IDB) and the World Labor Organization (ILO), conducted the first study on the country’s labor force. The results showed that 58.2% of the active labor force had not received formal education or had only completed primary education. The study also showed that less than 10% of the workforce had higher education (see chart 3).

Chart 3. Level of education in the active Guyanese labor force. Source: Bureau of Statistics of Guyana, 2018.

For this reason, the country needs to make a serious effort to build human capital – knowledge, skills, creativity, and well-being – by improving the education and health system. Such conditions are essential if the population is to effectively benefit from the wealth generated by the production of oil and other natural resources as well as generate ways to add the value needed to achieve the desired diversification of the country’s economy (DOE, 2019). However, this is also an issue that can only be overcome in a medium to long-term time frame. For this reason, in order to fill the specialized labor gaps, the country will need to reattract the Guyanese human resources that left the country and attract foreign professionals (Goldwill, 2019).

Lastly, but also crucial to the success of the Guyanese development plans, the country needs to overcome infrastructure gaps. In recent years, the Granger government has increased investments in this area, but Guyana still lacks the necessary infrastructure in vital sectors such as transportation (road, water, and air), energy, telecommunications, water, solid waste, health, education, among others (Foreign Affairs, 2018). Thus, the government needs to make disciplined progress in implementing the country’s heavy infrastructure development plans. Moreover, investment in infrastructure can also bring great returns by enabling new economic activities, improving competitiveness and expansion of existing ones, and improving the population’s quality of life.

Conclusions

The boom in Guyana’s oil industry has created a unique opportunity for the country’s economic development. Due to the size of the economy and the population, the impact of increased oil production in the coming years will place the country as one of the fastest-growing economies in the world during this decade. The guidelines of the plans to guide the use of government revenues that are already reaching the state arches, point in the right direction. Since 2016, the Guyanese government has been formulating long-term plans to boost national development and avoid adverse effects such as the resource curse and the paradox of plenty. However, as seen in the previous section, there are great uncertainties and challenges to be overcome to ensure that the country can make adequate use of those resources.

Thus, the success of Guyana will depend on the possibility of building acceptable levels of institutional capacity to manage the activities of the young oil industry and other sectors of the economy transparently and effectively. It will also depend on governance conditions to shield institutions and public policy guidelines from any decision or interest that could divert government efforts from the development objectives embodied in the plans already formulated. In this sense, lowering tensions among the dominant political sectors in the country, the commitment to respect democratic institutions, and the continuity of public policies are key to ensuring that the country can achieve acceptable results in the long term.

The effectiveness of the development plans will depend on the possibility that the population can adequately benefit from the wealth that is beginning to flow in. This will only be possible through investment in human capital and infrastructure so that citizens can develop capacities and skills, and progressively insert themselves in productive activities linked to the oil industry or other sectors of the economy. In this sense, it will be a medium and long-term effort. Finally, it is important to stress that Guyana has a unique window of opportunity of twenty years, or even less, in which projections still point oil as the dominant source in the global energy mix. We will see if it will be effectively used.

Further Reading on E-International Relations

- Climate Justice from Theory to Practice: The Responsibility and Duties of the Oil Industry

- Oil Power Politics amidst a Global Pandemic

- Doom, Boom or Hibernation? Covid-19 and the Defense Industry

- Oil During COVID-19: Essential Service or Subsidized Resource?

- Developing Global Champions: Why National Oil Companies Expand Abroad

- Opinion – Compromising US Energy Security for International Oil Market Stability