This essay will argue that China is not using the Asian Infrastructure Investment Bank (AIIB) to reinvent Asian regionalism; rather it will complement and strengthen the existing regionalism and the multilateral development institutions that underpin this order. While it is true that economic regionalism is becoming more China-centred, it is in keeping with Asia’s open regionalism and is not a reinvention. ‘Reinventing regionalism’ would denote a radical alteration of the existing regional architecture – economic, political, and security. Given that the focus of AIIB is restricted to the political-economy domain, its influence will be limited in security and political regionalism. Although it is difficult to say with certainty, the development of a broader China-led security institution appears unlikely in the near future due to the mistrust surrounding China’s geopolitical ambitions in the region. If China wants to head regional security or political institutions, it will require significant reform of China’s regional policy by addressing its expansive territorial claims and transparency on its military and economic endeavors (Acharya, 2015a; 2015b: 5-6).

The essay with begin with a brief explanation of Asian regionalism in the context of the initial question. It will be followed by a section on the structure of AIIB and the concerns that have been raised about the nature of the institution. While this essay argues that such fears are exaggerated, it does not suggest that China is motivated by purely altruistic concerns. There are tangible benefits that China will receive with the success AIIB. It denotes important changes in Asia and globally – that China is willing to take initiative in Asian institution building, previously dominated by ASEAN or other Western or Western-allied powers like Japan. If AIIB is a success, the ideological implications will be huge for China, which will make the prospect of a China-centred regionalism encompassing political, economic and security regionalism in Asia more likely in the long run.

What is Asian Regionalism?

Traditionally, regionalism has been understood as ‘preferential trade agreements’ which were created by countries in the 1930s to protect themselves from the Great Depression (Bhagwati, 1992: 535). Kanishka Jayasuriya (in Katzenstein, 2000: 354), defines regionalism as ‘a set of cognitive practices shaped by language and political discourse, which through the creation of concepts, metaphors, analogies, determine how the region is defined; these serve to define the actors who are included (and excluded) within the region and thereby enable the emergence of a regional entity and identity’.

In the context of this essay, it would be more fitting to use the concept of regionalism as inter-governmental collaborations, with greater focus on the functionalist dimension of regionalism like trade, security and other issues, to achieve closer regional integration. Such relationships are not intended to promote regional relationships at the expense of global relationships, rather it is meant to complement it to the advantage of individual countries, the regional order, and the global order (ADB, 2008; Milner, 2017).

AIIB can further be linked to the idea of ‘developmental regionalism’, “linking development, regionalism and capacity-building” across Asian countries which suffer from underinvestment in infrastructure (Dent, 2008: 767). As China has learnt from its own experience of economic growth, investment in infrastructure would help in enhancing the economic capacity and economic growth of these countries; this would help in improvement of overall regional productivity. China would also receive strategic benefits with the development of infrastructure in the region as it will lead to increase in trade competitiveness and economic capacity of countries in the region.

ASEAN Centrality and the AIIB Threat

The Association of Southeast Asian Nations (ASEAN), which is a cluster of small states, has been the primary driving force of the regional architecture of Asia. AIIB signifies the first serious initiative taken by China to lead in Asian institution building, which was previously led by ASEAN or other traditional Western powers or Western-allied powers like Japan, for example, Asia-Pacific Economic Cooperation (APEC), Shanghai Cooperation Organization (SCO), ASEAN Regional Forum, ASEAN plus three; China has been a key player in many of these institutions (Kahler, 2013: 724; Acharya, 2015b: 3). China’s new initiative further cements the move away from Deng Xiaoping’s famous dictum of ‘Keeping a low profile’ towards Xi Jinping’s ‘Striving for achievement’. AIIB is significant not just for China, but also globally because it is the first major multilateral development bank since 1991 (Chin, 2016: 11).

Sceptics have pointed out that the recent efforts by China towards institution-building in Asia threaten the centrality of ASEAN in Asian regionalism. However, this is only partially true. While China’s initiatives and growing power put further pressure on ASEAN, there has already been mounting pressure on ASEAN centrality in recent times due to other reasons like intra-ASEAN divisions and disunity, and great power competition in Asia-Pacific (Acharya, 2015b). ASEAN’s better record of unity in conflict management in the initial years was due to it being a smaller group which made it easier to reach a consensus, however, today, it’s issue agenda has greatly expanded and includes a much larger group of actors which makes unity difficult (Acharya, 2016a). Such questions about ASEAN centrality being hampered by the AIIB are exaggerated as AIIB is not going to replace ASEAN initiated institutions, rather in keeping with Asia’s ‘open regionalism’, it aims to complement and strengthen the existing framework (Acharya, 2015b: 4).

AIIB – Goals

According to its intended purpose, the AIIB is meant to complement the efforts of existing development financing institutions like the World Bank and Asian Development Bank (ADB) which currently fund development activities in Asia; however, the focus of AIIB is narrower and on building infrastructure that will enhance connectivity between the regional economies (Ikenberry & Lim, 2017: 10). A report published by ADB in 2009 states that ‘between 2010 and 2020, Asia will need to invest $8 trillion in national infrastructure and an additional $290 billion in regional infrastructure projects in transport and energy’ (ADB Report, 2009, in Ren, 2016: 436). However, the ADB has less than $160 billion of available capital and the World Bank has $223 billion of available capital. There are clear gaps between the demand and supply of funds. If the AIIB is successful, it will help to compensate for the gaps in infrastructure financing of existing multilateral institutions in Asia like the World Bank and Asian Development Bank (ADB). China’s successful experience of economic growth was founded on prioritising infrastructure construction, something which many Asian countries are currently lacking in and could benefit immensely from prioritising (Ren, 2016: 436-437). This was the main motivation behind the proposal of AIIB in 2013.

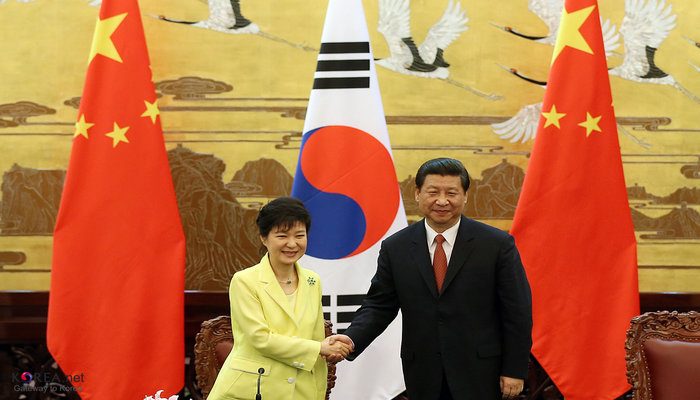

In October 2014, a memorandum of understanding (MoU) was signed with representatives of 21 countries. Despite non-participation by United States and Japan, the Articles of Agreement of the AIIB were signed by fifty-seven founding members in June 2015, with 61 members currently and many non-regional members like United Kingdom, Germany and Brazil (AIIB, 2017). Notwithstanding dissuasion from the United States, a number of allies of the US (Australia, South Korea, Britain, Germany, and France) decided to join the AIIB. The involvement of Western countries turned AIIB into a more legitimate multilateral financial venture, as Beijing is relatively inexperienced in creating and managing a multilateral institution and could learn from the positive experiences of these countries (Yang, 2016: 763).

The other important factor behind this external innovation by China is the frustration over the Western dominance over existing multilateral bodies, which hindered China and other developing countries from having a greater say in the decision making of these institutions (Ren, 2016: 436; Ikenberry & Lin, 2017). Institutional adjustments in the World Bank which were meant to change the voting weights of various developing countries have been insufficient and the influence of developing countries, including China, remains very small compared to that of US, Japan and other EU members (Strand, et al., 2016). This is perceived as unfair because of the growing role of developing countries in global economic governance. Thus, the AIIB reflects the frustration with existing global financial institutions and the need to compensate for the gaps in infrastructure financing in Asia. If China’s efforts with AIIB are successful, it will allow developing countries to have more influence in policymaking within the multilateral order.

The AIIB in conjunction with other initiatives like the One Belt One Road Initiative does serve strategic goals for China, like the benefits derived from a more integrated and connected Asia; however, these are common goals for the region as a whole (Callaghan & Hubbard, 2016: 117). The AIIB can also support China’s ongoing domestic transition from investment-led growth to consumption-led of growth. Moreover, in the long term, it can promote internationalization of China’s currency, the Renminbi (Ikenberry & Lim, 2017: 10-11). This would be especially significant in that it could potentially provide an alternative to the dollar, which has been under fire since the financial crisis of 2008-09, in turn the centrality of the dollar in the international monetary system could be questioned (Kahler, 2013: 714).

Structure – Continuities and Changes

Since the time of its proposal to the signing of the Articles of Agreement, the AIIB has been reshaped through the process of accommodation and reform. Throughout the process of formation of AIIB, China’s inputs helped shape the new institution and its own role was redefined by outside players. This was a process of mutual shaping and reshaping of one another which shows that other countries play an important role in shaping AIIB (Ren, 2016: 438).

China initially planned to contribute 50% of the capital requirement of the new bank giving it effective unilateral control over AIIB’s decision making. However, as the number of member states increased, it reduced to 26%, in turn reducing its voting share. This was a result of pressure from western members, Germany and United Kingdom, and more members, which diluted China’s capital input (Chin, 2016; Ikenberry & Lim, 2017). China’s 26 percent voting share in AIIB gives it effective veto over major decisions requiring a super majority of 75 percent. However, this is not unlike the US veto power over World Bank decisions which require a super majority of 85 percent (Callaghan & Hubbard, 2016: 129).

AIIB’s voting structure conforms with existing practices of multilateral development banks and regional development banks. AIIB follows a weighted voting system like other multilateral development banks, with bonus votes for its founding members (Strand, et al., 2016: 64). In contrast to most multilateral financial institutions, AIIB’s Articles of Agreement aims to preserve the influence of Asian regional members by reserving at least 75% of the votes for Asian members (Chin, 2016: 14). This is similar to regional development banks where regional members have greater influence within the institution, however, unlike most RDBs membership is not limited to Asian members (Strand, et al., 2016: 64).

Like existing MDBs, it will have a three-layered governance structure with a Board of Governors with fifty-seven governors, Board of Directors with twelve directors and management/ staff. Since more influence is reserved for regional members, nine out of the twelve seats are held by regional members on the Board of Directors (Strand, et al., 2016: 64). Additionally, unlike the IMF and World Bank, the Boards are to be non-resident. There were a number of people who were sceptical of this move, however, it has been pointed out that having a non-resident board of directors may in fact be the rational decision, as they may be able to provide more strategic oversight and resident boards often slow down the decision-making process (Chin, 2016: 15-16). If the non-resident board arrangement succeeds, it will be a major improvement over the existing arrangements in World Bank and Asian Development Bank (Callaghan & Hubbard, 2016: 132).

The election of a President is also a deviation from the practices of existing MDBs. A national of a regional member country can be appointed the President, unlike previous multilateral lending institutions like the World Bank where the president has always been an American, the IMF where the president has always been European, and the governor of the ADB who has always been Japanese (Chin, 2016: 14). This is a positive step as other countries have played a major role in shaping the institution.

As discussed in depth in other articles (Chin, 2016; Yang, 2016), China presents both conformity and institutional innovation in the institution building process of AIIB. However, it is necessary for a new institution to broadly adhere to existing international practices and standards to gain legitimacy and credibility, which prevents it from introducing radical changes. Therefore, based on its institutional structure, it can be observed that AIIB does not diverge significantly from practices of older institutions. Where there has been innovation, it has been in the positive direction and can be seen as an improvement on existing practices.

Concerns

There have been concerns about China dominating the new bank. However, these were allayed with the reduction in voting percentage of China in the bank. There were also concerns about AIIB’s good governance, transparency and lending practices being inconsistent with existing multilateral lenders and environmental and social standards of the MDBs. However, Beijing insisted that AIIB would follow the norms and functions of existing multilateral development banks. If it does not meet the lending standards of the MDBs, it will lead to China losing credibility which would be costly as a rising power.

Political constraints imposed by multilateralism will require China to make compromises. An example of this is the reduction of its voting share as mentioned earlier (Ikenberry & Lim, 2017). Institution building, and innovation is especially difficult during this time because China faces a heavily institutionalised Asia, with many global and regional multilateral institutions in place already which came into existence under the liberal international order (Ikenberry & Lim, 2017). The membership of AIIB overlaps heavily with membership of existing multilateral development institutions which are scattered across the regional architecture. Given the benefits states have already reaped from being a member, it is unlikely that any state will participate in AIIB at the expense of existing institutions withdraw from existing institutions to participate in AIIB (Acharya, 2015b: 4). This means that it will be difficult, if not impossible, for China to introduce any revisionist or radical changes in the institutional landscape of the region because such an outcome would require cooperation from multiple states.

Throughout the twentieth century, the presence of the United States in Asia has been significant, and thus it occupies an important part of the regional architecture. However, with the election of Trump into office, decline of Obama’s ‘pivot’ and withdrawal from Trans-Pacific Partnership, there might be signs of waning presence. The decline of US from the region is the result of multiple long-term structural factors (Acharya, 2016b). There is a tendency to frame AIIB in opposition to US-led multilateral lending institutions like the World Bank, which oversimplifies AIIB to a vehicle for China to achieve its own selfish gains, and increases the suspicions among other states (Callaghan & Hubbard, 2016: 116). However, being a major benefactor from the existing order, it is in China’s interest to maintain the status quo. Thus, the fears and concerns regarding AIIB reinventing the existing regionalism or disrupting the order that it is underpinned by, are exaggerated.

Prospects

However, there is a potential that given the success of AIIB and the One Belt One Road Initiative, there will be more scope and influence for China to pursue its security and geopolitical agenda. There is a growing sense of dissatisfaction among developing countries with existing Bretton Woods multilateral development banks, with delays in loan approvals which can take more than two years, and differences in the preferred route of addressing structural problems like economic development in underdeveloped areas (Chin, 2016: 18; Strand, et al., 2016: 56). For example, India has turned to AIIB for $100 billion financing for the country’s coal energy projects after criticizing the World Bank for denying India, a developing county, cheap access to power, despite having the world’s largest coal reserves and a desperate need of electricity infrastructure (Chin, 2016: 19). If AIIB can offer countries like India the desired result, it will help China in getting more influence within the existing institutional order at the expense of the United States (Ikenberry & Lim, 2017: 11). The success of AIIB can potentially have an important ideological role to play in favour of China in the constant struggle of defining norms which often translate into influence; this can help China achieve its long term geopolitical goals (Beeson, 2015). Successful institutional leadership and authority over a successful institution will confer the status of a ‘responsible stakeholder’ and can play an important role of expanding China’s influence within the region and beyond (ibid: 8).

Conclusion

This essay has argued that China is not using the AIIB to reinvent Asian regionalism, rather the new bank will strengthen the existing regionalism by increasing connectivity between countries. AIIB was introduced to fill in the gaps of infrastructure financing in Asia. While there might be a growing shift towards China-centred economic regionalism, this is in keeping with Asia’s inclusive and open regionalism. It is evident that there are examples of both conformity and innovation in the institutional design of AIIB, however, the innovations are not radical and, if successful, will be improvements on the existing structure of MDBs. Since the process of building multilateral institution requires negotiation with multiple countries, the role of China and AIIB, largely conforms with existing norms. If AIIB succeeds with China as a ‘responsible stakeholder’ there is a possibility that in the future China will get much more influence and status within the international order and gain enough credibility to lead a broader multilateral institution in the region.

Bibliography

Acharya, A. (2015a) ‘No Need to Fear the AIIB’, The Straits Times (Singapore), 19 June, available at: http://www.straitstimes.com/opinion/no-need-to-fear-the-aiib

Acharya, A. (2015b) ‘Introduction: “Alternative” Regional Institutions in Asia? A Cautionary Note’, Georgetown Journal of Asian Affairs, 3-6. Policy Forum: Alternative Perspectives: Institution building or Breaking? Spring/Summer.

Acharya, A. (2016a) ‘Security Pluralism in the Asia-Pacific’, Global Asia, 11(1): 12-17.

Acharya, A. (2016b). Interview with Mercy A. Kuo for The Diplomat, 10 November, available at https://thediplomat.com/2016/11/the-end-of-american-world-order/

Asian Development Bank (2008). Why Asian Regionalism?, in Emerging Asian Regionalism. Philippines: Asian Development Bank, pp 10-24.

Asian Infrastructure Investment Bank (2017) ‘Members and Prospective Members of the Bank’, available at: https://www.aiib.org/en/about-aiib/governance/members-of-bank/index.html , accessed 8 January 2018.

Beeson, M. (2015) ‘Geopolitics versus Geoeconomics: The New International Order’, 14 March, available at: https://theconversation.com/geopolitics-versus-geoeconomics-the-new-international-order-38824

Bhagwati, J. (1992) ‘Regionalism versus multilateralism’, The World Economy, 15(5): 535-556.

Callaghan, M. & Hubbard, P. (2016) ‘The Asian Infrastructure Investment Bank: Multilateralism on the Silk Road’, China Economic Journal, 9(2): 116-139

Chin, G. T. (2016) ‘Asian infrastructure investment Bank: governance innovation and prospects’, Global Governance: A Review of Multilateralism and International Organizations, 22(1): 11-25.

Dent, C. M. (2008) ‘The Asian Development Bank and Developmental Regionalism in East Asia’, Third World Quarterly, 29(4): 767-786.

Ikenberry, G. J., & Lim, D. J. (2017), China’s emerging institutional statecraft: The Asian Infrastructure Investment Bank and the Prospects for Counter-hegemony, Project on International Order and Strategy, Washington, D.C: Brookings Institution.

Kahler, M. (2013) ‘Rising Powers and Global Governance: Negotiating Change in a Resilient Status Quo’, International Affairs, 89(3): 711-729.

Katzenstein, P.J. (2000) ‘Regionalism and Asia’, New Political Economy, 5(3): 353-368.

Milner, A. (2017) ‘Regionalism in Asia’, Centre for ASEAN Regionalism University of Malaya, available at: https://carum.my/publication/regionalism-in-asia/ , accessed 8 January 2018.

Ren, X. (2016) ‘China as an institution-builder: the case of the AIIB’, The Pacific Review, 29(3): 435-442.

Strand, J.R., Flores, E.M., & Trevathan, M.W. (2016) ‘China’s Leadership in Global Economic Governance and the Creation of the Asian Infrastructure Investment Bank’, Rising Powers Quarterly, 1 (1): 55-69.

Yang, H. (2016) ‘The Asian Infrastructure Investment Bank and Status-Seeking: China’s Foray into Global Economic Governance’, Chinese Political Science Review, 1(4): 754-778.

Written by: Amreeta Priyadarshini Das

Written at: University of Bristol

Written for: Professor Yongjin Zhang

Date written: January 2018

Further Reading on E-International Relations

- China’s Instrument or Europe’s Influence? Safeguard Policies in the AIIB

- Why Is China’s Belt and Road Initiative Being Questioned by Japan and India?

- Are We Entering an “Asian Century?”: The Possibility of a New International Order

- The Origins of Regionalism in the EU and ASEAN

- Interregionalism Matters: Why ASEAN Is the Key to EU Strategic Autonomy

- Is China the New Hegemon of East Asia?